The price action of the XRP on February 18, 2025 reflects the short -term bear pressure against the background of critical support tests. Technical indicators signal the careful optimism for the rebound if key levels are held.

XRP

The 1-hour diagram reveals a clear descending trend marked with lower maximums and minimums, while the XRP is traded from $ 2.48 to $ 2.52 for the last hour. Direct support is $ 2.45–2.50, while resistance reaches upwards by $ 2.60–2.65. Volumetric spikes on red candles emphasize increased sale, which indicates the bearish impulse.

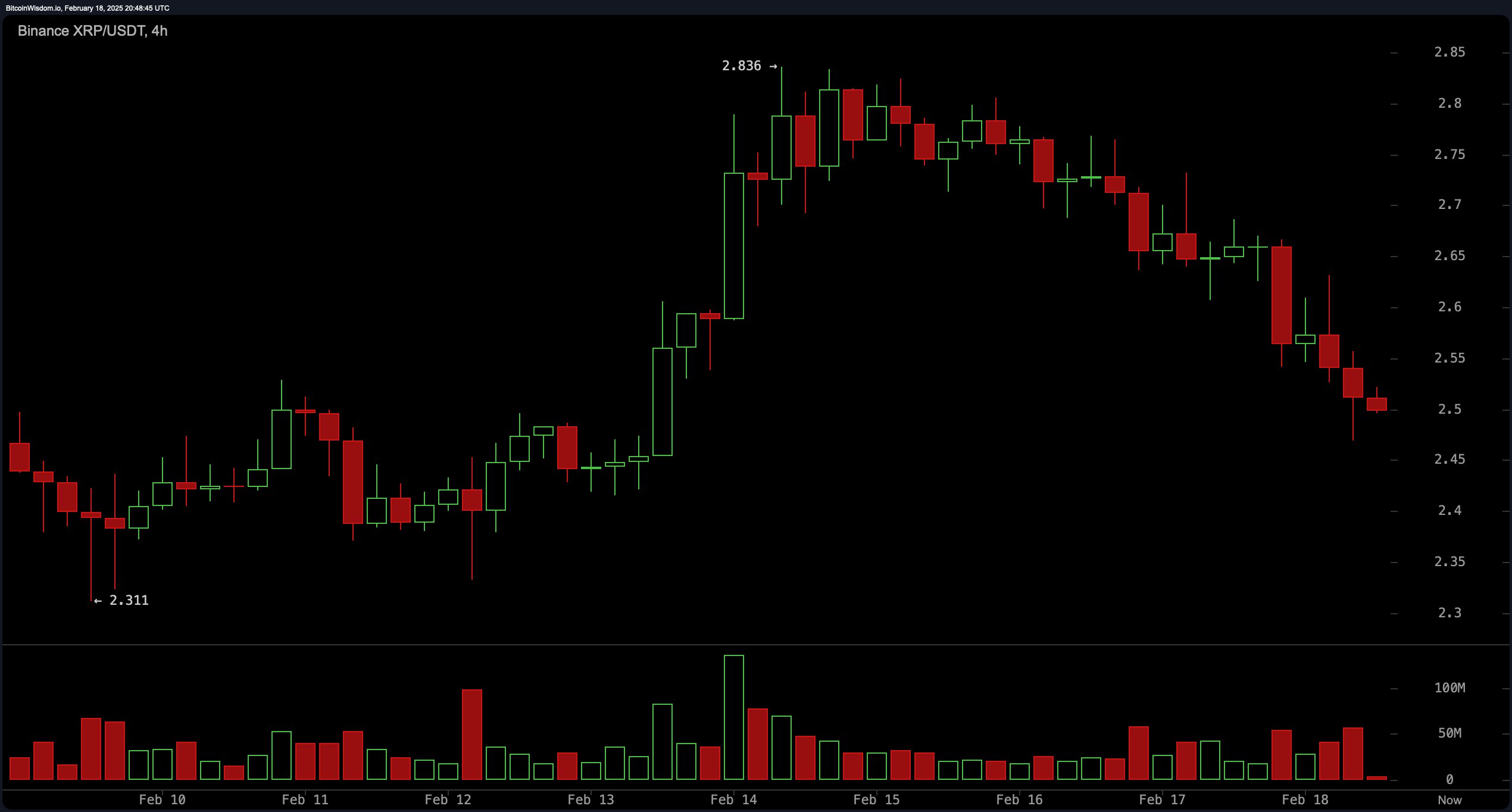

The 4-hour date emphasizes the Bear change after a deviation of $ 2.80–2.85, and XRP forms smaller maximums and minimums to support $ 2.40–2.45 US dollars. Resistance of $ 2.65–2.75 remains key; Close above $ 2.60 can cause a repeated test of this zone. Nevertheless, the inability to withhold $ 2.40 can accelerate a decrease to 2.20–2.30 US dollars. Traiders must control these thresholds to confirm the short -term direction.

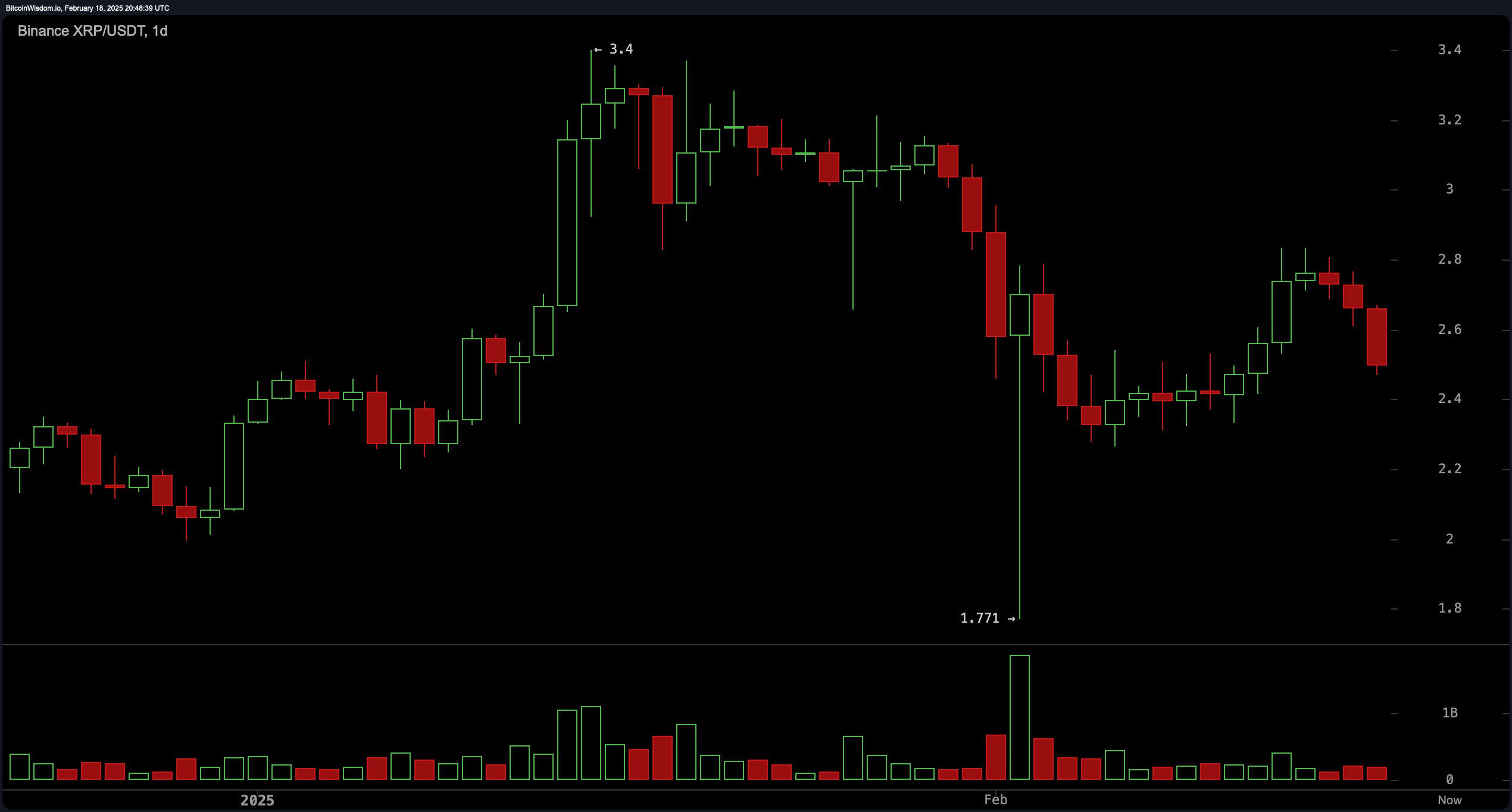

The daily diagram shows that the XRP is restored from immersion to $ 1.77, currently consolidating above $ 2.40 after an unsuccessful rally of about $ 2.80–3.00. While a wider trend remains optimistic, repeated deviations with lower maximums suggest indecision. Sustainable deduction above $ 2.40 can revive an impulse of $ 2.80+, but the breakdown here can cancel the recovery prospects, identifying a support group of $ 2.20–2.40.

Indications for the daily XRP diagram and key generators draw a picture with neutral to mixing: relative force (RSI) index at 43.34 and stochastic at 66.50 both signal neutralities. On the contrary, the commodity channels (CCI) at -19.56 and the average direction (14) (ADX) at 30.83 reflect the suppressed pulse. It is noteworthy that the impulse indicator advises the sale of 0.079, contrasting with the purchase signal from the divergence of the sliding average (MACD) divergence at -0.040.

The average sliding medium -sized in the vast majority imply a pressure on the sale: an exponential sliding average (10) (EMA) at 2.60 and a simple sliding average (10) (SMA) at 2.57 both sales of signals. However, the average values, thin, with an exponential sliding average (200) (EMA) in 1.73 and a simple sliding medium (200) (SMA) at 1.43 flashing purchase signals. This discrepancy emphasizes the tug of war between the nearest bearishness and the potential of long -term recovery.

Bull’s verdict:

The bull scenario depends on the XRP that protects the support zone in the amount of $ 2.40–2.45, which is consistent with the purchase signals due to the divergence of convergence of the sliding average (12, 26) (MACD) and long-term sliding medium (EMA 200/SMA 200). The removal above $ 2.60 can confirm the updated bull impulse, aiming at the resistance group in the amount of $ 2.80–3.00, supported by the narrative on the restoration of the Daily Charg and resold conditions in a shorter time.

Bear Verdict:

The bearish result increases the thrust if the XRP violates $ 2.40, accelerates the pressure of sales, as shown by dominant calls from short -term sliding means (EMA 10/SMA 10) and pulse indicator (10). Lower maximums on 1 hour and 4-hour graphs, combined with red candles supported by volume, suggest a second test of $ 2.20–2.30. The inability to restore the resistance range in the amount of $ 2.65 will emphasize the descending trend, incorrect hopes for restoration.