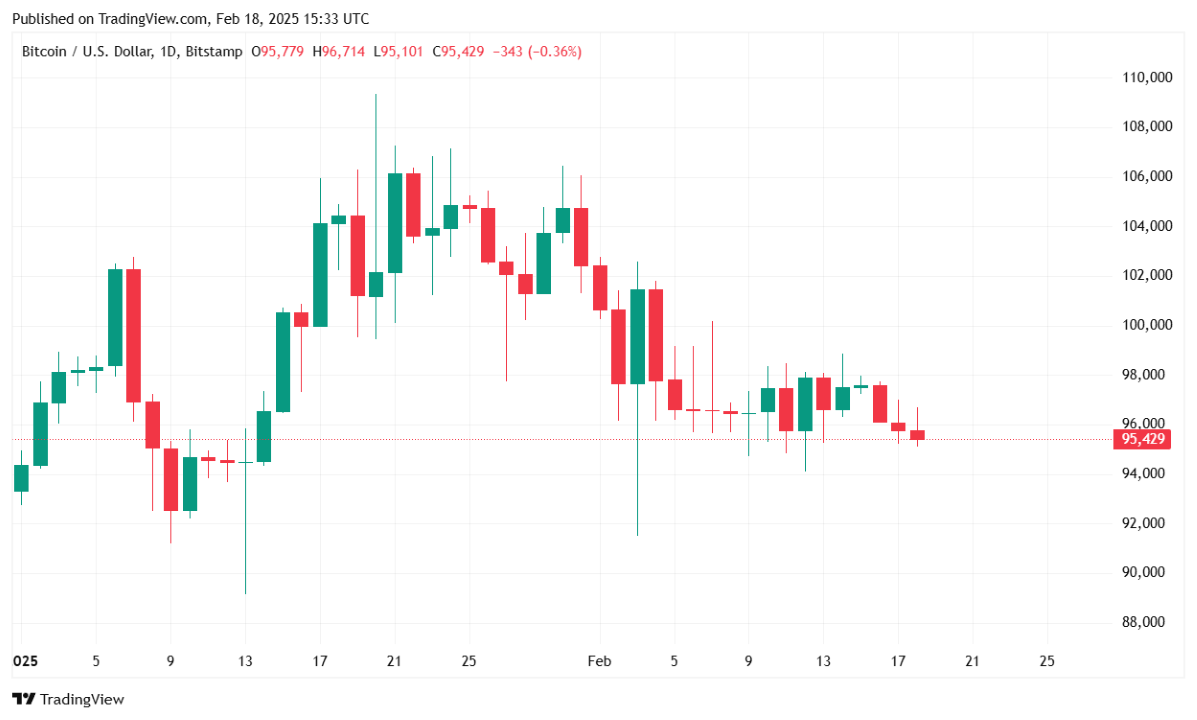

The price of BTC fell below 96,000 US dollars and remained at a distance of about $ 95,000 early on Tuesday morning, even when trading activities continued to rise.

The market activity is enhanced, but bitcoin falls below the threshold of $ 96 thousand.

Bitcoin (BTC) experiences descending pressure, despite a noticeable increase in the volume of trading, signaling the cautious but active market. At the time of the BTC reporting costs $ 95,750.96, which reflects a decrease by 0.92% over the past 24 hours and 1.21% over the past week. Cryptocurrency fluctuated in a 24-hour range from $ 95,118.38 to U.S. 900.02 dollars, which indicates a further struggle for the restoration of higher levels.

The trading volume increases as the bitcoins slip

Despite the decrease in bitcoin prices, the market activity intensified. The 24-hour trade volume of BTC increased by 20.87% to $ 28.17 billion. USA, which involves an increase in participation from traders. Nevertheless, a higher volume has not been transferred to a bull impulse, since sellers continue to exert pressure on the market. Meanwhile, Bitcoin market capitalization decreased slightly by 0.76%, settling at 1.91 trillion dollars, which reflects the impact of the current price reduction.

Bitcoin -Domination of the edge is higher against the background of altcoin weakness

BTC dominance has grown by 0.17% over the past 24 hours to 61.24%, according to Trading View. This growth assumes that investors are disconnected from more risky altcoins, especially after the ongoing defeat of the scales, in which the outflines of capital from Solana (Solar) in more established cryptocurrencies, such as Bitcoin and Ether (ETH).

The futures market shows an increase in open interest

According to Coinglass, the activity of the futures market also showed growth when BTC Futures rises 0.59% to 61.42 billion dollars. This growth indicates that traders increase their positions with a borrowed education, possibly waiting for more prices in the near future. However, whether this leads to a bull or bear breakthrough is still unknown.

Liquidation suggests that bull merchants were taken by surprise

Data on the liquidation from the coating of the coating suggests that the rethought long traders bear the main severity of the recent drop in prices. The total liquidation over the past 24 hours amounted to $ 30.84 million. USA, and long liquidations amounted to $ 22.16 million. USA, and short liquidations – 8.68 million dollars. USA. These data emphasize the constant uncertainty in the market and the potential for further volatility.

The prospect of the Bitcoins market

The current price effect of Bitcoin involves the flow market, with an increase in the volume of bidding and futures that open interest indicating increased speculations. BTC dominance growth signals a safe place in conditions of uncertainty associated with alternative cryptocurrencies.

In order for Bitcoin to restore the impulse upward, he will need to break through from the resistance of about 97,000 US dollars, which limited recent attempts to restore. On the other hand, support of $ 95,000 will be crucial to prevent further decline. Since traders control macroeconomic trends and events in a wider crypto -landshaft, the next large step of Bitcoin probably depends on whether bull moods can restore traction in the coming days.