Toncoin (Ton) demonstrates the growing signs of accumulation, which suggest market data, indicate the upcoming changes in its price action.

Meanwhile, a decrease in the market value of the tone shows signs that the sale of sales can reach its peak. The ongoing current market models lead to signs that restoration can materialize.

Accumulation trends involve market positioning

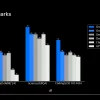

Recent data on the crypted show that the 180-day ratio of Sharpe Tone indicates the ongoing accumulation. A long descending trend suggests that speculations slowed down, which allowed investors to build positions at lower prices.

Changes in the decentralized exchange activity (DEX) and the consistent general value are blocked (TVL) in lending additionally confirm this trend.

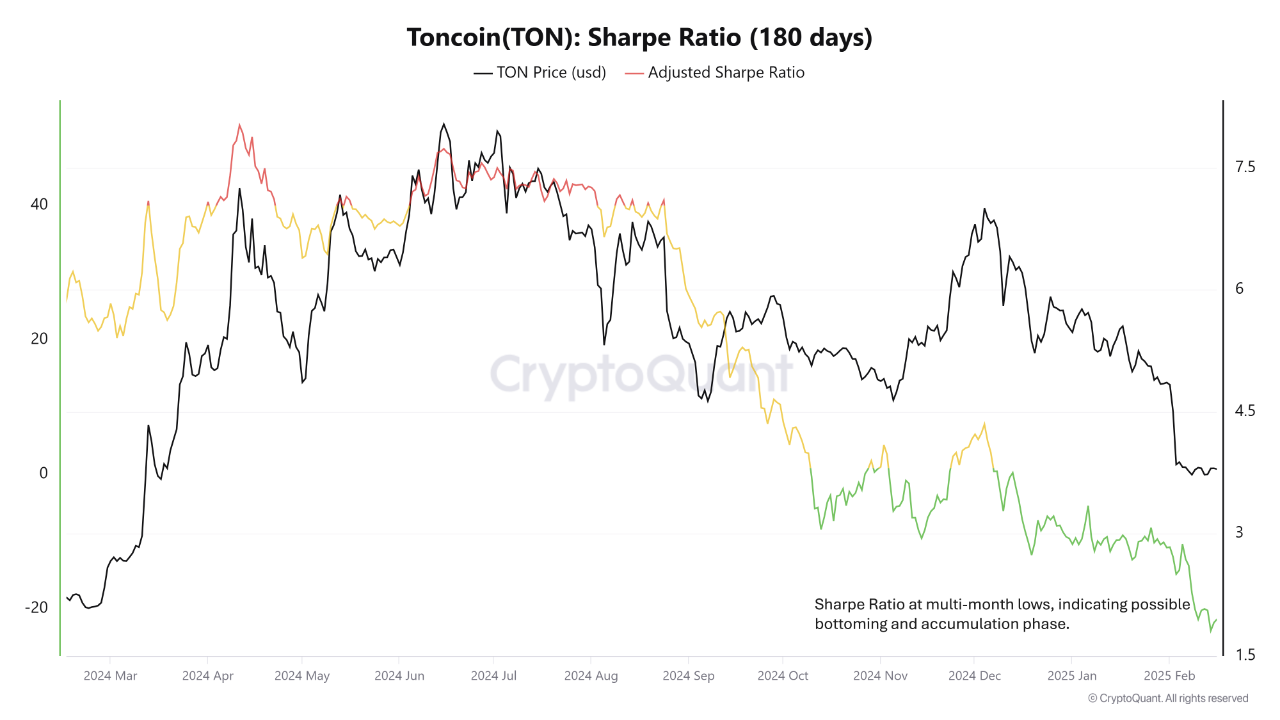

Prices correlated with anomalies both in the medium -term, normalized risk indicator (NRM) and in volatility in December 2024 and February 2025.

From -with stable prices, combined with a decrease in volatility, the market can show signs of reducing the activity of suppliers.

The upcoming market conditions can lead to price restoration, because demand shows signs of improvement.

Long -term owners show strong beliefs

The normalized risk indicator of the tone shows that investors are building positions at a price that reaches $ 3.82.

Recent historical events have shown that previous phases are usually developing before the recovery of the market occurred.

The long -term NRM has reached the lowest levels in history, which indicates that long -term investors strategically position themselves in anticipation of the increase in the cost of shares.

Additional indicators also indicate accumulation. The likelihood of expenses, which measures the probability of selling more old coins, remains low. This suggests that investors holding a ton for more than 400 days are not actively sold, signaling about trust in the long -term potential of the asset.

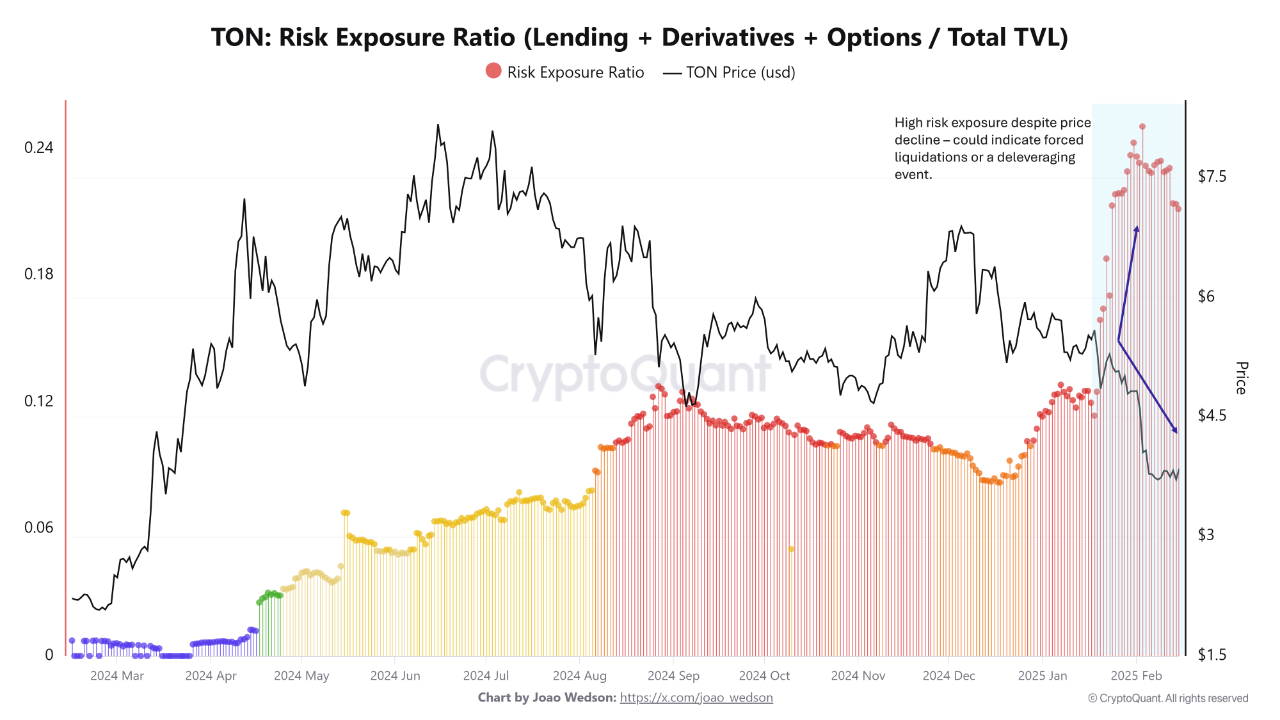

Leverse and the risk of exposure to the market

The risk coefficient showing positions using using the use of the General TWL exceeded 0.24 at the beginning of 2025.

Advanced positions using borrowed investments are a significant segment of Defi on Ton.

Market stability can improve, while prices of prices become healthier when this ratio begins to develop down.

The sales positions of short-medium owners, apparently, are currently taking place, while long-term owners retain their investments stable. The current market situation corresponds to the historical models of accumulation, which are previously followed by long periods of negative profitability to recovery.

The market signals a potential change, since a decrease in risk exposure in combination with constant accumulation from long -term owners.

Reduced volatility of Toncono with a potential breakthrough

The market value of TON showed a decrease in price fluctuations during recent trade days. According to the crypto analyst by Ali Martinez, the tightening stripes of the Bolinger on the 12-hour graphics usually predict the upcoming significant price fluctuations.

“Phys of low volatility often lead to quick prices,” Martinez said.

However, it remains unclear whether the next step up or down will be.

The tone looks like a change, because the demand for the purchase remains stable, while the pressure in sale becomes less intense. The market expects strong signs of a possible breakthrough in the coming weeks.