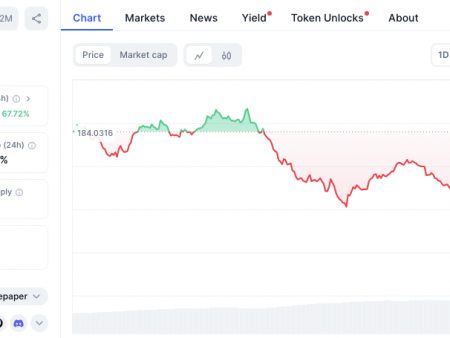

The star price has retreated sharply over the past few months. The XLM token reached $ 0.6420 in December last year, and then crashed to the current $ 0.3295. He switched to a deep bear after plunged by about 50% from the highest level in December. So, stellar gaps – a good purchase or sale at these levels?

Star price forecast

The price of XLM has remained under pressure over the past few months, as it collapsed by almost 50% from the highest point in 2023. It has already advanced below 50-day and 100-day exponential average movements (EMA), a sign that bears are gaining strength.

The star price is approaching the first levels of the Woodie Point point. He also formed a diagram of the head and shoulders, a popular sign of a bear turn. In addition, Stellar fell below the lower part of the Murrey Math Lines Tool.

Therefore, the price of XLM will probably continue to fall, since sellers are aimed at a weak stop and change point of $ 0.2440.

From the point of view of the positive side, the coin formed a falling scheme of the wedge table, a popular bull sign of reverse in the market. Nevertheless, the distribution between the two falling trend lines indicates that the descending trend can continue in the coming weeks.

XLM has numerous catalysts

There are several fundamental catalysts that can push the Lumens stellar price higher in the coming weeks.

Firstly, there are signs that the securities and exchanges commission (SEC) will approve the point XRP ETF at the end of this year. All the signs are that the agency, under the new chairman of Paul Atkins, will accept a different approach than Gary Gensler. In this, he will approve of quality funds, especially in US cryptocurrencies.

The approval of the XRP ETF will increase the likelihood that the SEC will approve the point XLM ETF, which was filed by Canary Capital. XRP and XLM are often considered as cousins, since the founder of Stellar was also part of the team that began Ripple. Two crypto projects are also in the money transfers industry.

Spot XLM ETF will popularize the network and lead to a larger number of tributaries from Wall investors, as we saw with Bitcoin and Ethereum.

Soroban ecosystem everything is fine

Secondly, there are signs that Soroban, the Stellar Layer-1 network, succeeds in the fact that the general value is blocked (TVL) on the network. TVL rose to a record maximum of $ 61 million, compared to last year’s minimum of $ 7.5 million. Some of the largest players in the Defi industry – Lumenswap, Blend and Aquarius Stellar.

Stellar is also a leading player in the real industry of asset tokenization (RWA). Fobxx Assets Franklin Templeton reached more than $ 372 million.

Thirdly, the star price can benefit from the upcoming bouncer bouncer. The weekly schedule shows that the drawing of the bull flag diagram and the sample of the cup and handle indicating a possible return in the coming months. Altcoins, such as Stellar, always succeed when Bitcoin is in a strong rising trend.

In addition, over the past few weeks, Stellar futures have crashed. He fell from last year’s maximum of $ 1346 million to $ 1346 million. The fall of the future open interest is often the opposite catalyst for cryptocurrency. For example, interest reached $ 26 million ahead of the November surge.

Star Price Forecast: here is the prospect for the XLM token was the first on Invezz