The movement of capital in the blockchain of networks is always a key sign for assessing the trust of investors and network activities. Looking at the last week, Base Blockchain went out in the first place for a positive pure stream, doing better than all other chains.

Solan was right behind, taking the second place even with constant concerns about the stability of the network.

Base and Solana dominate the blockchain grid.

Bitcoin, Ethereum and Arbitrum also saw positive clean streams, although not so many. On the other hand, Polygon Pos, Sui and Starknet had minor tributaries, while Avalanche C-chain and Op Mainnet experienced significant outflows.

It is noteworthy that Op Mainnet had the largest outflow of capital, demonstrating the weaker moods of investors in relation to this chain.

The base is the only chain that works better than $ SOL.

Surprisingly, given the mood about $ SOL. pic.twitter.com/fuc1mthfug

– Altcoin Buzz (@altcoinbuzzio) February 18, 2025

The base overtakes Solana in the influx of capital

Even with the uncertainty of the market, the base has become a leader in the field of a clean tributary of capital. This is quite noticeable, especially considering the leading position of Solana recently

Market moods in relation to Solan were mixed, mainly from the past of past interruptions and conversations in centralization. Nevertheless, his ability to continue to attract strong tributaries involves confidence in its long -term potential. A recent flow of money emphasizes the optimism of investors, even when prices in the short term move up and decrease.

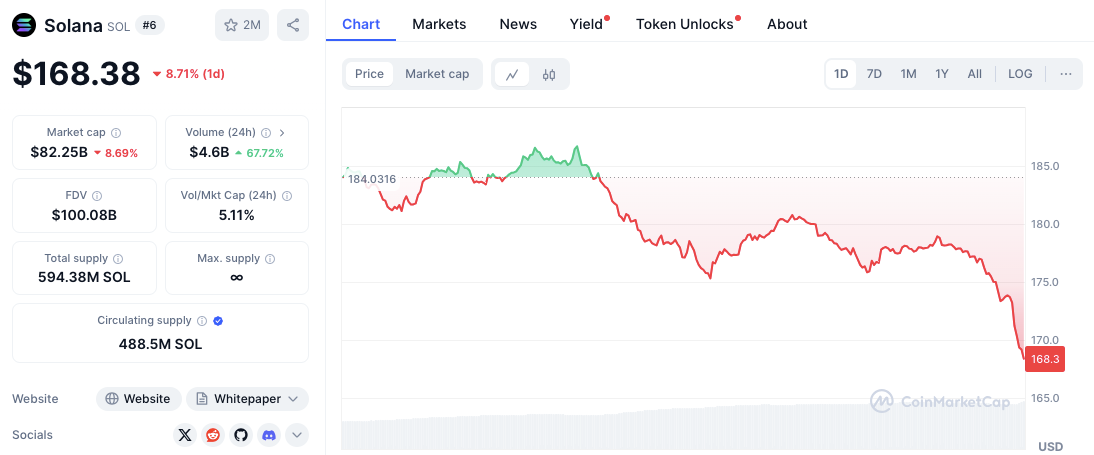

SOLANA price analysis: key levels for viewing

The price of Solana has recently declined, currently bargaining by $ 172.16 after a fall by 6.45% over the past 24 hours.

Initially, the price reached an intra -day maximum in 184.03 US dollars before impressing resistance, causing a tendency to decrease. The strong level of resistance appeared about 184–186 dollars, where the pressure increased on sale, which led to the rollback.

Key support levels are 172, $ 170 and the range from 165 to 168 dollars. If the price does not remain above $ 172, a further decline can push it to $ 170. A stronger breakdown can lead to a second test in the support zone from 165 to 168 dollars, where buyers can return to the market.

Market moods remain careful: the volume of trading increased by 61.85%, which demonstrates more activity mainly from sellers.

Solana’s market capitalization also decreased by 6.45%, which indicates a decrease in investor confidence. Nevertheless, the restoration of more than $ 176 can change the impulse, potentially pushing the price to the range of $ 180.

Connected: Solana Meme coins fell by 91%, but analysts see signs of a massive rebound

Technical indicators indicate caution

The relative force (RSI) index is currently 31.27, approaching the territory of resellibility. This suggests that a potential rebound can happen when the purchase is increased. Nevertheless, the descending RSI trajectory indicates that bear feelings remain dominant.

In addition, the divergence of slip convergence (MACD) shows a bearish crossover. The MACD line is at -2.69, below the signal line B -10.11, confirming the lack of pressure. Negative histograms even more enhance the prevailing bear’s impulse.

February 2025 ATSIS VERSION FOR SOLANA

Forecasts in the Coincodex market for February 2025 suggest a potential increase in prices to 10.51%, which will lead to the average SOLANA price to about 189.50 US dollars.

Connected: Despite the difficult year, Solana demonstrates growth in some key areas

Predictable price fluctuations are indicated from the range from 177.26 to 195.47 US dollars. If these forecasts are correct, SOLANA can provide a short -term yield of about 13.99% of current levels.

Refusal of responsibility: The information presented in this article is intended only for information and educational purposes. The article is not a financial advice or what -liba tips. Coin Edition is not responsible for any losses incurred as a result of the use of content, products or the services mentioned. Readers are recommended to be careful before taking any actions related to the company.