Desireless Pudgy Penguins shows signs of the bottom after a failure by almost 90% of his record maximum.

Pudgy Penguins (Pengu) The price rose to $ 0.011 on Friday, which is almost 20% of its record minimum.

Token restoration occurs, since these third-party parties show a sharp decrease in Pudgy Penguins sales due to a reduction in demand. According to Cryptoslam, sales have fallen by 55% over the past seven days to $ 5.1 million. The number of transactions fell by 45% to 186, while the number of buyers fell to only 97.

Sales have also decreased over the past 30 days, decreasing by 57% to $ 44 million. During the same period of transactions and buyers decreased by 29% and 38%, respectively.

Additional data indicate that the monthly trading volume has also fallen. After an increase to $ 114 million in December, the volume decreased to $ 43 million in January and is currently $ 12.9 million. USA this month.

The price action of PENGU reflects the action of ATECOIN (APE), token created by Yuga Labs, the Bul Ape Yacht Club command. APE initially increased to $ 27 after its Airdrop 2022, but since then it has been divided by more than 95%.

Ping’s price can be below

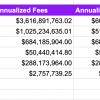

There are signs that Pengu may have reached the bottom. Its futures interest increased to $ 80 million from a record maximum of more than $ 266 million. Historically, strong rebounds often arise when futures for open interest are significantly reduced.

Technically, the price of “chubby penguins” discovered strong support of $ 0.0095, where she could not cross this month. This had about five attempts to crash below this support point.

This month, the coin also could not rise above the resistance at 0.01130 dollars. This consolidation may be a sign that the bulls accumulate. According to Wyckoff theory, this accumulation phase is usually accompanied by a cost that has a higher demand than the offer. It is also characterized by fear of skipping animals -spirit.

The Bull Breakthrough above the resistance can push the ping in the 23.6% level of the recovery of Fibonacci at 0.0185 US dollars, which represents a potential 65% increase from current levels.