January 17, Thursday, on the crypto market there was a noticeable increase, since the price of Bitcoin is trying to regain a mark of 100 thousand dollars. Among the 100 best cryptocurrencies, the price of Litecoin causes leadership with a 20% surge among the buzzing around the potential ETF LTC. The renewable recovery established assets to challenge the resistance held for more than 1000 days. Is spray inevitable?

Currently, the LTC market capitalization is $ 9.65 billion, and the 24-hour bidding is $ 2.58 billion.

Key basic points:

- NASDAQ submitted a proposal to the SEC in accordance with the rule of 19B-4 for the transfer and trade of Canary Litecoin ETF,

- In the current correction, 117 and 88 dollars cost key support of crypto buyers.

- The price in Litecoin is 13.5% of the decisive breakthrough of the cup and the handle diagram.

The price of Litecoin takes off when ETF is supplied by Sparks Overtim IMMPORM

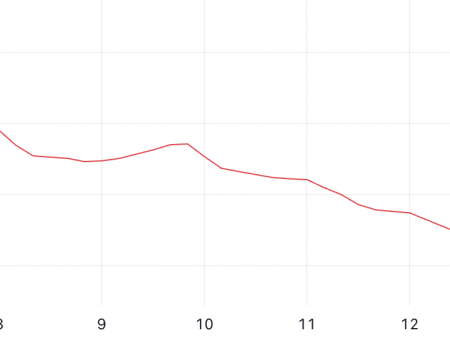

At a three -day rally, the price of Litecoin increased from 97.5 to 127.7 dollars in the United States, registering an increase of 31%. Thus, a bull turn may be due to the NASDAQ to submit a proposal to the securities and exchanges commission (SEC) in accordance with the rule of 19B-4 for the transfer and trade of Canary Litecoin ETF.

This step signals that potentially may be the first Altcoin ETF 2025, noting the historical moment for Litecoin (LTC) and a wider altcoin market. In case of approval, this ETF can legalize Litecoin in the eyes of traditional investors, which can lead to its demand and market profile.

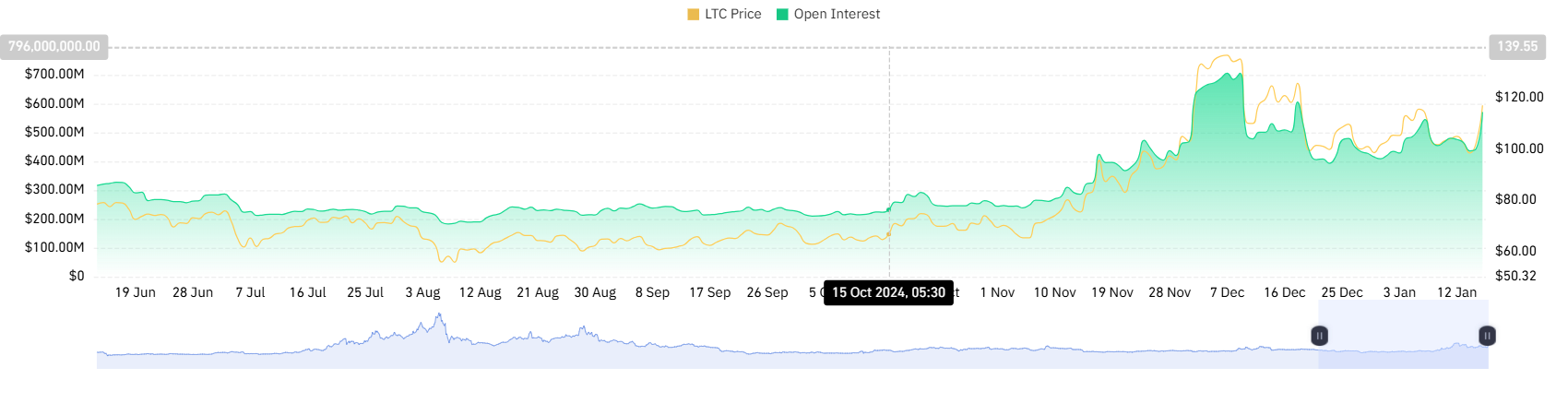

In addition to a bull’s note, an open percentage of LTC shows a sharp surge up to $ 571 million. These data from Coinglass Hits imply the growing activity of traders and an increased expectation of potential prices.

Cup & Handle Pattern Drives Recovery LTC

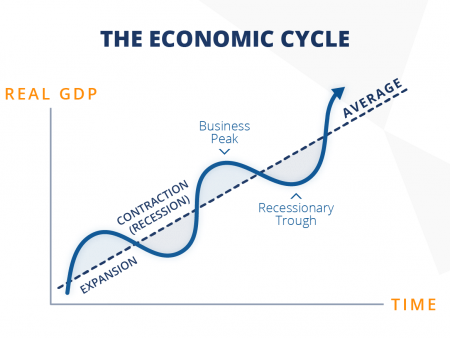

The analysis of the weekly diagram Litecoin shows the formation of the image of a cup and a sple. The template displays a long accumulation zone since January 2022 and a temporary rollback to restore a bull impulse.

Currently, the price of LTC is currently trading at $ 127, which is 13.5% of the calling the cutting resistance on the vein of $ 144. The current impulse caused by a wider market recovery and Buzz can probably surpass this barrier and turn potential support.

A rally after a break can push the asset by another 72%to reach $ 250.

On the contrary, if sellers protected the cutting of the neckline, the current consolidation can last until next month.