The price of Cardano (ADA) is down about 18% over the past seven days, in line with the broader market after a period of consistent gains. But beyond price, activity on the Cardano network is also feeling the heat.

This overall decline around the project has raised concerns about the altcoin’s short-term performance. According to this online analysis, these concerns may be justified.

Cardano faces a major obstacle

On December 8, Cardano’s price rose to a yearly high of $1.22. But today the price of the cryptocurrency fell to $0.88 due to noticeable sales. While ADA holders can expect a rebound within a short period of time, In/Out of Money About Price (IOMAP) analysis shows that it may not be easy.

IOMAP is an indicator that determines support and resistance in the chain. To do this, the indicator compares addresses with unrealized profits and losses. Typically, the higher the volume in a price range, the stronger the support or resistance.

According to IntoTheBlock, the main resistance for ADA is at $0.92. In this area, 58,470 Cardano addresses have accumulated 951.02 million tokens, which exceeds the number of tokens in the money between $0.74 and $0.88.

If buying pressure remains low, then the price of ADA may find it difficult to rise above the current price. Instead, the token may undergo an extended correction.

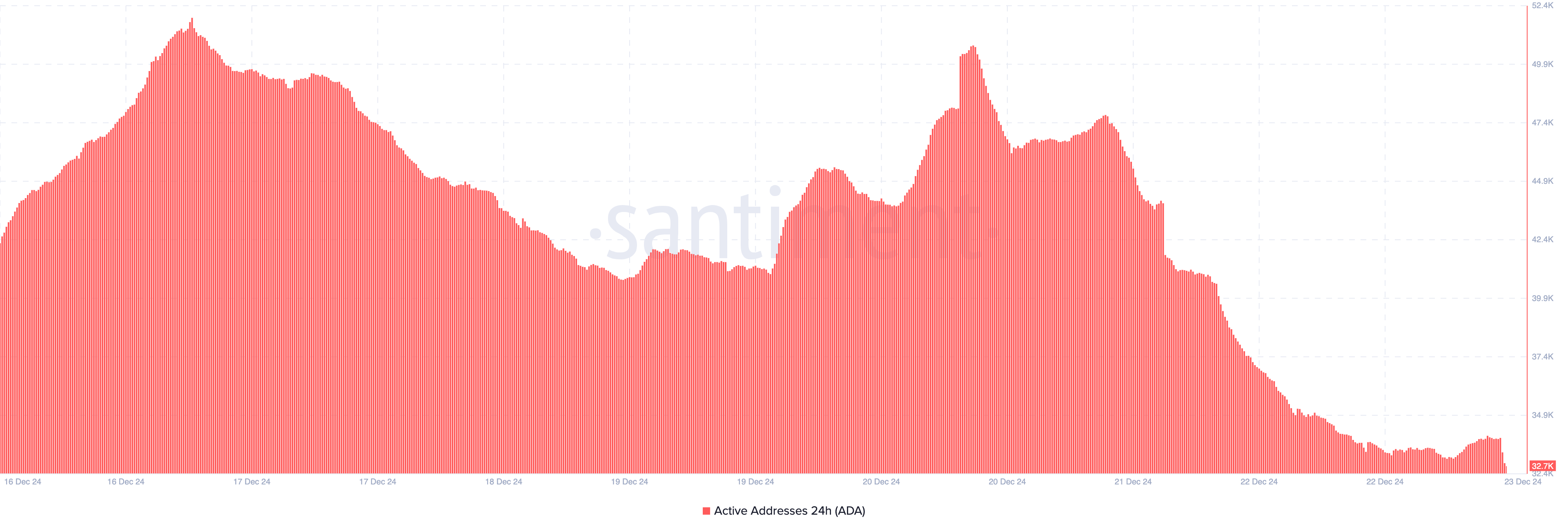

Santiment data supports this view, highlighting a significant decline in Cardano network activity. On December 16, the number of 24-hour active addresses exceeded 51,000, but at the time of publication this figure had fallen to 32,700.

An active address is defined as a wallet that has participated in a successful transaction (both sender and recipient) within a certain period. This metric serves as a reliable indicator of daily user activity on the blockchain.

An increase in the number of active addresses signals increased user activity, which is usually bullish for price action. Thus, the continued decline in this indicator suggests bearish sentiment towards ADA.

ADA Price Forecast: Extended Correction Is Inevitable

From a technical perspective, the exponential moving average (EMA) suggests that Cardano’s price may continue to decline. EMA is an indicator that measures the trend around a cryptocurrency.

On the daily chart, the price of ADA fell below the 20 EMA (blue). A fall below the EMA suggests a bearish outlook. Additionally, the token price is around the same level as the 50 EMA (yellow).

This position indicates that Cardano is on the verge of losing support at $0.88. If the situation remains the same, the price of ADA could drop to $0.77. In an extreme bearish scenario, the price of the altcoin could drop to $0.55.

However, if Cardano network activity increases, this trend may change. In this case, the value of the cryptocurrency could jump to $1.33.