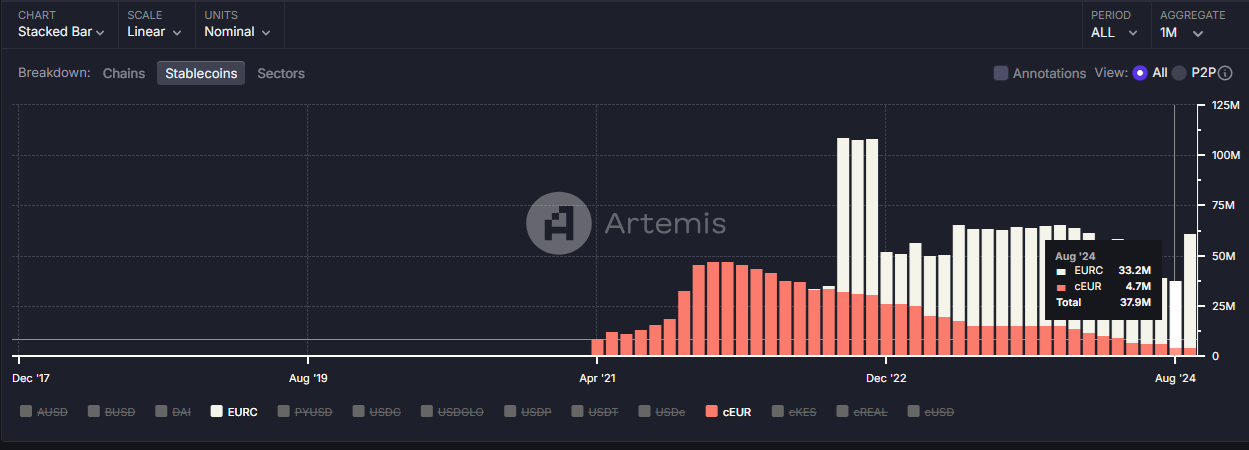

The euro has been a largely forgotten currency in the heavily dollarized stablecoin space. Being a less intuitive asset, the tokenized euro lagged behind. Now EURC by Circle is set to expand more aggressively, more than doubling its supply since August.

EURC is now the most widely accepted euro-based stablecoin following supply expansion over the past two months. EURC is returning to supply levels not seen since 2022 as its supply has been shrinking for years during the bear market. The asset supply increased from a market capitalization of $36 million to more than $75 million.

EURC has 67.9 million tokens in circulation, with most of the growth over the past month occurring on the Base chain. EURC also displaced the Celo-based asset cEUR, which even reduced supply due to low demand.

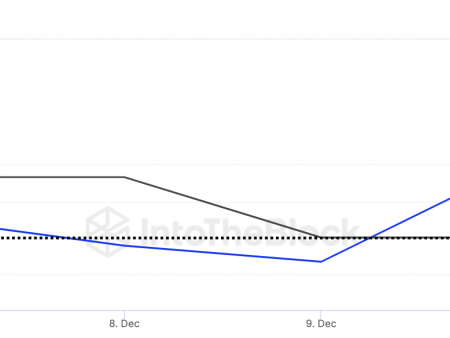

The euro-based asset is trading at a slight premium of US$1.12 per coin compared to the exchange rate of US$1.11 per euro. The asset is already listed on centralized exchanges such as Binance and Coinbase.

EURC gets support from decentralized swaps

Circle launched its EURC asset in July this year with the goal of adding another transparent fiat-backed asset to the Base. Circle has continued to print USDC on Base, delivering new DeFi applications to the network.

As of September, EURC is very active on Aerodrome Slipstream, a high-performance DeFi trading engine that provides additional liquidity at a predetermined price range. More than 62% of all EURC activity is concentrated on a single Aerodrome DEX pair. Airdrop is also one of the growth drivers for both USDC and EURC as the locked value of DEX has risen to US$1.114 billion. Both USDC and EURC are built with decentralized applications in mind and are compatible with most lending and trading protocols.

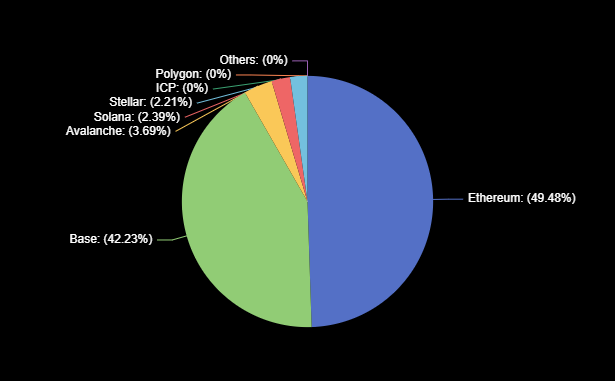

EURC trades against USDT and offers another tool for moving to and from DeFi protocols. EURC has experimental mints on Polygon and Solana, as well as less widely used networks such as Stellar, Avalanche and Internet Computer (ICP). EURC is fully programmable and bridge compatible.

Eurostablecoins remained relatively rare in 2024, as eurozone traders will be able to rely on paper money or intuitive dollar prices. However, EURC looks like a completely legitimate onboarding tool, especially for Base users. On Coinbase, Euro users can exchange EURC without fees. The EURC/USDT pair is also intended to serve as a form of online Forex trading.

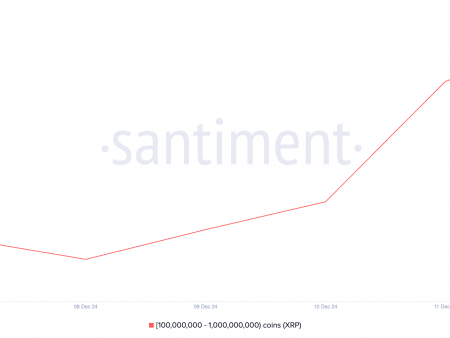

There are also few EURC owners: about 3,500. holders on the Ethereum blockchain. The majority of EURC tokens on Ethereum are owned by “whales” or protocols, with few payments between wallets or small holdings. At its base, EURC has around 2,222 holders, although most of the supply is locked in protocols like Morpho or in liquidity pools and passive income vaults.

Over 49% of the EURC supply circulates on Ethereum, with around 42% on Base following very active mining. EURC still has to catch up to USDC, which has 3.98 billion tokens in its Base. For USDC, Ethereum is also a more important chain, carrying more 67% minted tokens.

EURC has increased in importance after July 2024 and may attempt to completely replace other types of stablecoins. The asset is fully compliant with the Markets for Crypto-Asset Regulation (MiCA) thanks to its fiat backing. Circle has also received an electronic money institution (EMI) license in France and is testing eurozone banks as reserve holders.

The Euro-based token is also intended for businesses that have access to Circle Mint, a facility for exchanging Euros for tokens and vice versa. As of September 26, the EURC token reported reserves worth $60.9 million, which exceeds 60.1 million tokens in circulation. Last month, new EURC issuance was slightly higher than redemptions, with a net increase of 7.3 million tokens. USDC increased its supply in September by 1.9 billion tokens.

EURC and USDC are partially covered by bank reserves and the Circle Reserve Fund. The fund also consists of cash and short-term U.S. Treasury bills. The availability of paper money reserves and the coinage mechanism are sufficient to cover the MiCA requirements. As for USDT, its stated support from US Treasury bills is currently insufficient, since Tether does not have bank counterparties in the eurozone.

–

Cryptopolitical report by Kristina Vasilyeva.