The Sui Level 1 (SUI) blockchain is expected to unlock 64 million tokens on October 1, representing 2.40% of the total supply. As the crypto community eagerly awaits the release of these tokens, SUI is experiencing increased investor interest.

While token unlocks typically cause high volatility and sometimes price declines, this analysis highlights why the SUI price may not experience a significant drawdown and the rationale for projecting a much higher value following this event.

Sui is set to issue 64 million tokens, volume increases sharply

The price of SUI is up 115% in the last 30 days, largely due to Grayscale’s decision to launch SUI Trust. Additionally, the project’s total value locked (TVL) reached a new all-time high, indicating increased confidence in the altcoin’s potential.

Meanwhile, on Tuesday, October 1, the project will unlock 64.19 million tokens worth over $100 million. Token unlocking is the process by which previously restricted coins are released into circulation.

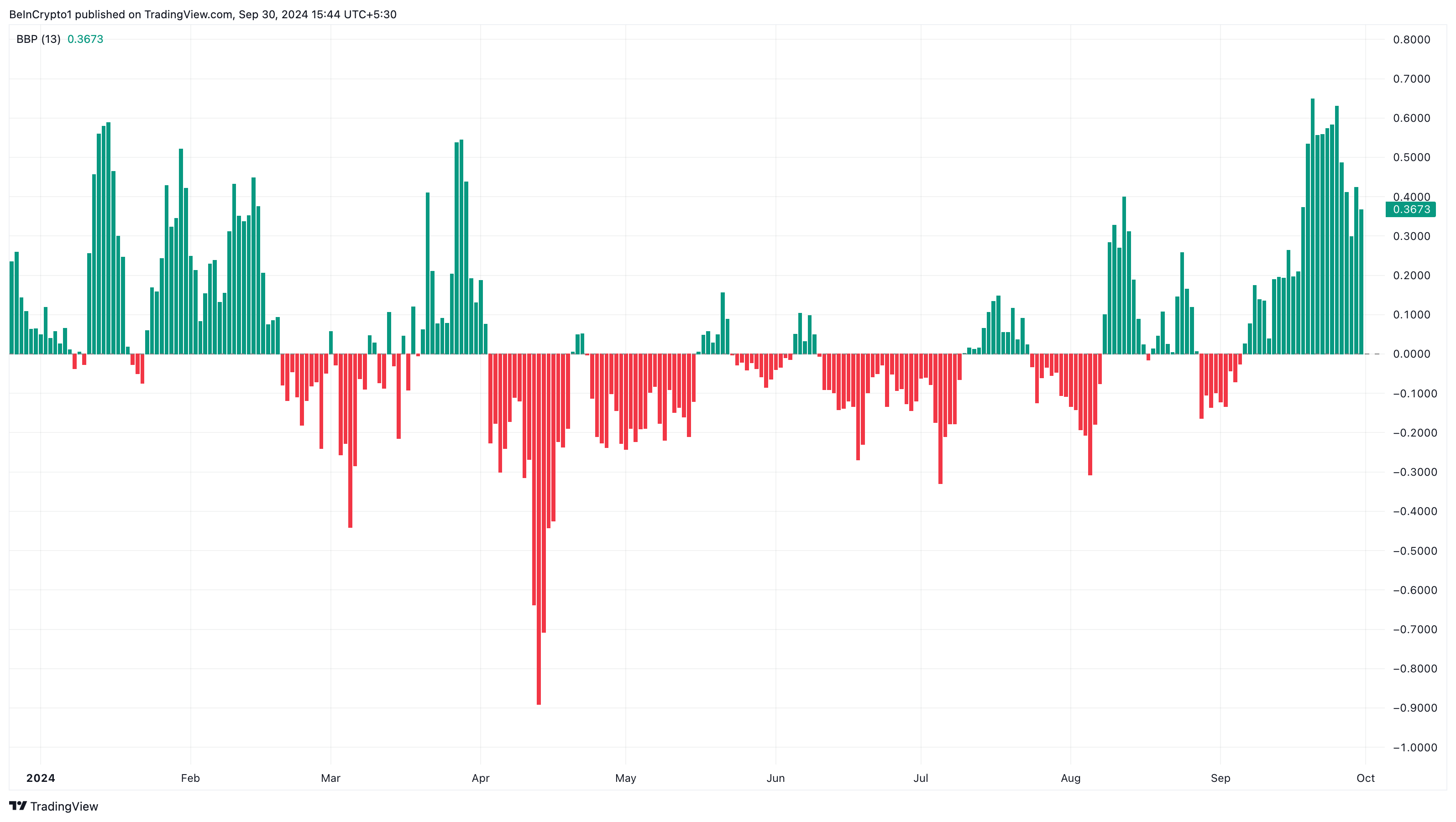

In most cases, this supply shock is accompanied by high volatility. However, on the daily chart, the Bull Bear Power (BBP) indicator, which measures the strength of buyers and sellers, shows that the bulls are in control.

Read more: Everything you need to know about the Sui blockchain

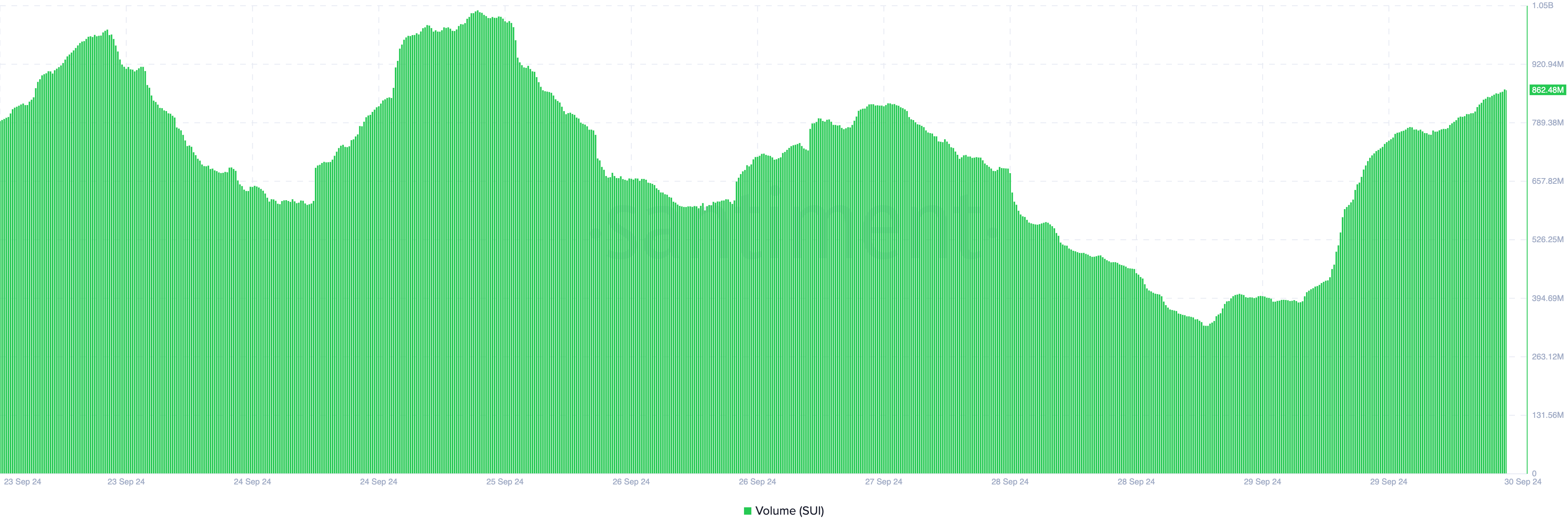

Thus, buying pressure is the most dominant, suggesting that the SUI price may jump above $1.73. Additionally, Sui’s volume also increased to $862.48 million.

Typically, an increase in the volume of purchases will lead to an increase in the price of the cryptocurrency. But for this to continue, the volume must grow. However, if volume declines as price rises, the uptrend may become weak and a potential reversal could be next.

In the case of SUI, the price has increased by 5% in the last 24 hours, while volume has increased by 122% over the same period. Thus, the current can continue to increase.

SUI price forecast: bears have no chance

A further look at the daily chart of SUI/USD shows that the altcoin continues to show significant strength. However, traders should be wary of the $1.90 region, which has historically been a crucial level for the SUI price.

For example, when the price of SUI tried to reach $2 in February, it experienced a push as soon as it reached $1.90. Currently, the altcoin is approaching the same zone. But if there is buying pressure, it is likely to break through the region.

Additionally, the 20-day exponential moving average (EMA) remains above the 50 EMA. This indicates that the bullish sentiment is still there and the price of SUI may continue to rise.

Read more: Guide to the 10 best Sui (SUI) wallets in 2024.

If buying pressure helps SUI break through the $1.90 resistance, the token could rise to $2.10. However, a wave of profit taking could push its value down to $1.45, invalidating the bullish outlook.