FET is establishing itself as a dominant force in the AI cryptocurrency space, surpassing its competitors in both market capitalization and trading volume. With 75% of addresses in profit and the recent golden cross signaling strong bullish momentum, FET could be on the verge of a significant rally.

As we approach key resistance levels, the potential for new all-time highs becomes increasingly possible.

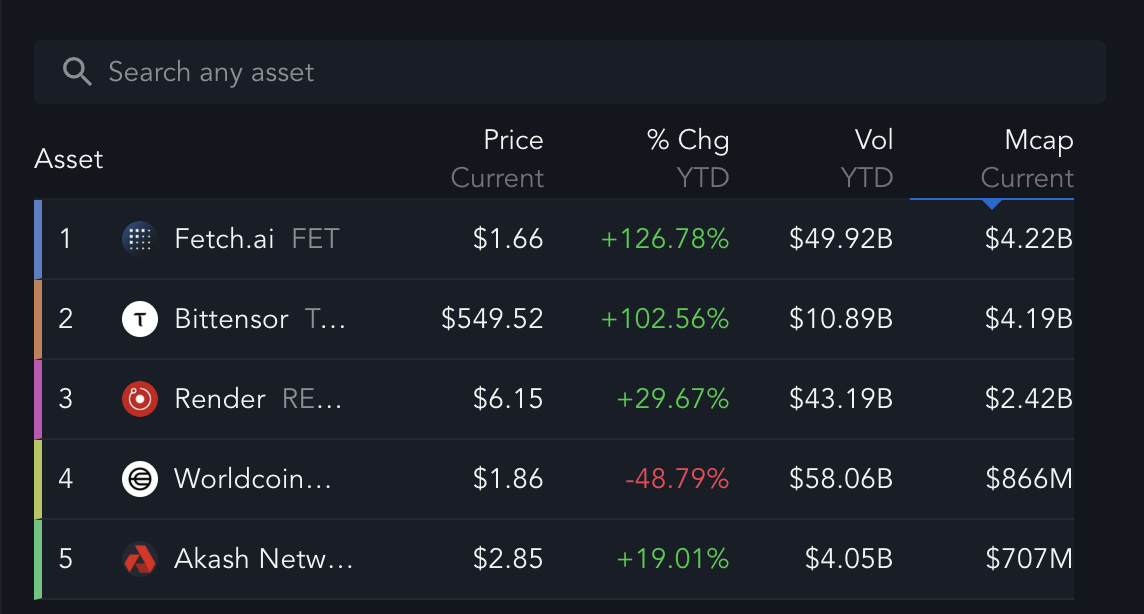

FET is ahead of its competitors in artificial intelligence

FET has positioned itself as a leader in the AI-powered cryptocurrency sector, with several factors cementing its dominance. FET currently has the largest market capitalization of any AI-related coin at $4.22 billion.

While Bittensor follows closely behind with a market capitalization of $4.19 billion, FET’s lead becomes even more pronounced when compared to the rest of the industry. Collectively, Render, Worldcoin, and Akash Network don’t even match FET’s market cap.

In 2024, FET recorded a staggering $49.92 billion in trading volume, more than 4.5 times the trading volume of Bittensor, its closest competitor. This discrepancy in volume is critical because it indicates the level of market interest and liquidity flowing through the FET.

Read more: How to invest in artificial intelligence (AI) cryptocurrencies?

Moreover, FET’s year-to-date (YTD) price is up an impressive 126.78%, beating not only Bittensor, which posted a strong but comparatively lower 102.56%. Higher volume often reflects higher demand and greater participation, all of which work in favor of the FET price.

Investors and traders are clearly gravitating towards FET, which could create a positive feedback loop in which its liquidity, visibility and relevance in the market will only continue to grow. This could also make FET the leading AI coin in the market, making it even more dominant.

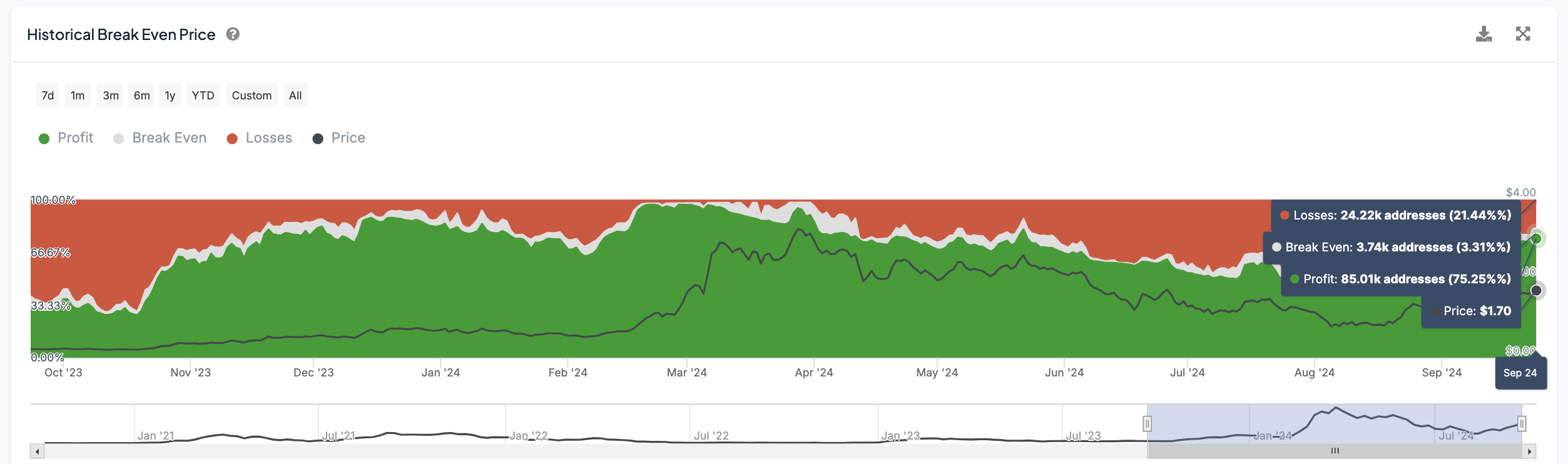

Profitable FET addresses could cause a new price surge

Currently, about 75.25% of all FET addresses are profitable, which means approximately 85,010 addresses are profitable at the current price of $1.70. However, about 21.44%, or 24,220 addresses, are experiencing losses, and a small part, 3.31%, or 3,740 addresses, are breaking even.

This distribution suggests that the majority of FET holders are confident in the future of the asset, having already seen positive returns on their positions. When a majority of holders are in profit, it usually signals strong market sentiment and the potential for further upward momentum as more investors are encouraged to enter the market.

Historically, a similar share of addresses in profits during a FET uptrend has resulted in explosive price increases, with the price skyrocketing over 500% in just one month. These past results show that when so many holders are already profiting, it creates the conditions for prices to rise quickly, especially if demand continues to rise.

Given the current percentage of addresses in profits, FET price could be poised for another significant rise, comparing it to previous bullish moves in price history.

FET Price Forecast: New All-Time High Coming?

FET recently formed a golden cross, a bullish technical pattern in which the short-term exponential moving average (EMA) crosses the long-term EMA. This pattern is often seen as a sign of increasing upward momentum, which is usually followed by further increases in prices. In the case of FET, the various EMA lines on the chart show a bullish direction, with short-term EMAs positioned above long-term ones.

EMAs are used to smooth out price data and identify trends more clearly. Unlike simple moving averages, EMAs give more weight to recent price movements, making them more sensitive. Traders typically monitor multiple EMAs, such as the 20-, 50-, 100-, and 200-day lines, to gauge the strength and direction of a trend. In the case of FET, these EMAs show a clear upward trajectory, reinforcing the bullish outlook.

Read More: 9 Best Artificial Intelligence (AI) Cryptocurrencies in 2024

If this uptrend continues, FET could test key resistance levels at $1.86 and $2.28. A break above these levels will strengthen the bullish sentiment, potentially leading to new resistance points at $2.70 and $3.48. Exceeding these levels could push FET to a new all-time high, signaling a strong bullish move.

But if the uptrend weakens and the FET price reverses, the support levels at $1.24 and $1.00 could become critical. If bearish sentiment continues, the price could fall further, potentially reaching $0.80. These key levels will determine whether FET can maintain its bullish momentum or whether a deeper correction is on the horizon.