Sei, a layer 1 blockchain for high-frequency cryptocurrency trading, has seen the price of its native token rise by more than 25% in the last 24 hours.

On September 25, Sei (SEI) rose from an intraday low of $0.366 to a high of $0.471 earlier in the day on major exchanges.

This is the token’s highest level since June 12, with its market capitalization rising to $1.6 billion, making it the 59th-largest digital asset in the world, according to CoinGecko.

The price rise was accompanied by a 187% increase in daily trading volume, which currently stands at approximately $523 million. Additionally, Coinglass data shows that SEI daily open interest was up 34.4% to $170.3 million at the time of writing, indicating increased investor activity fueling the ongoing SEI rally.

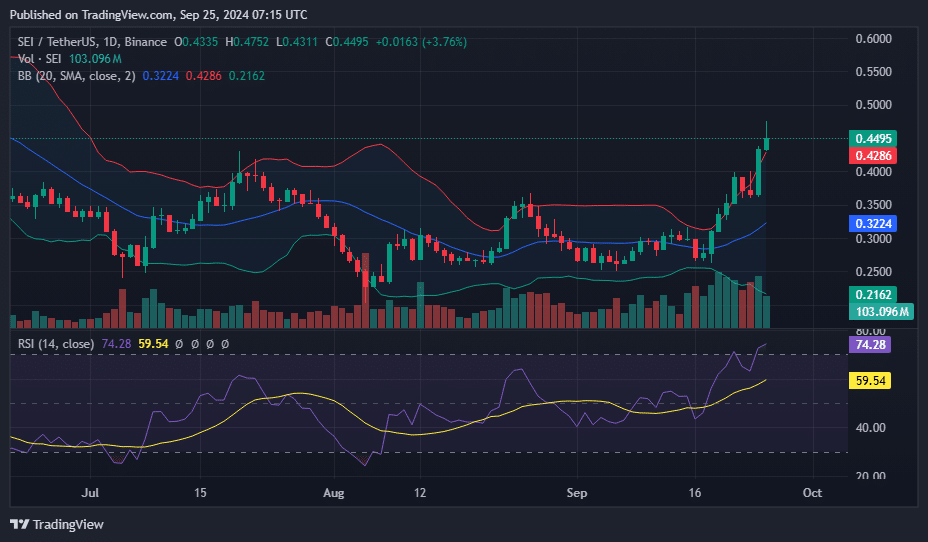

On the one-day chart, the SEI broke out of a falling wedge pattern, a technical setup that typically signals further upside potential.

It also broke through the upper Bollinger Band, which is located at $0.4503, indicating that upward momentum remains strong.

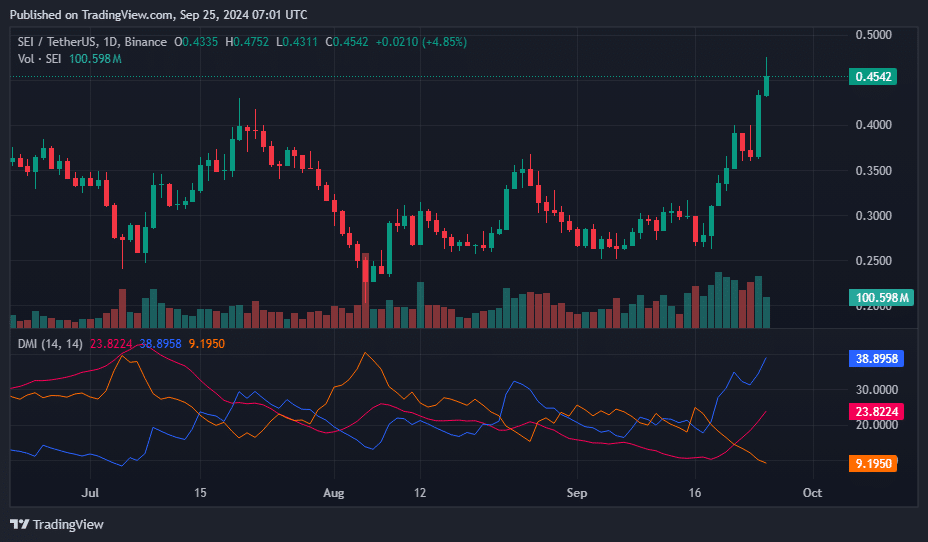

The Directional Movement Index shows increasing bullish momentum with rising +DI and falling -DI, indicating easing selling pressure. At the same time, the mean direction index is rising, indicating that the previously weak bullish trend is gaining strength.

Given the current trend, traders should keep an eye on the $0.50 mark, which could serve as the next psychological resistance. A successful breakout of this level coupled with strong volume could push the price towards $0.55 or higher.

However, an overbought relative strength index at 74 signals the possibility of a short-term correction or consolidation. In case of a reversal, the key support level could be the middle Bollinger band around $0.3224.

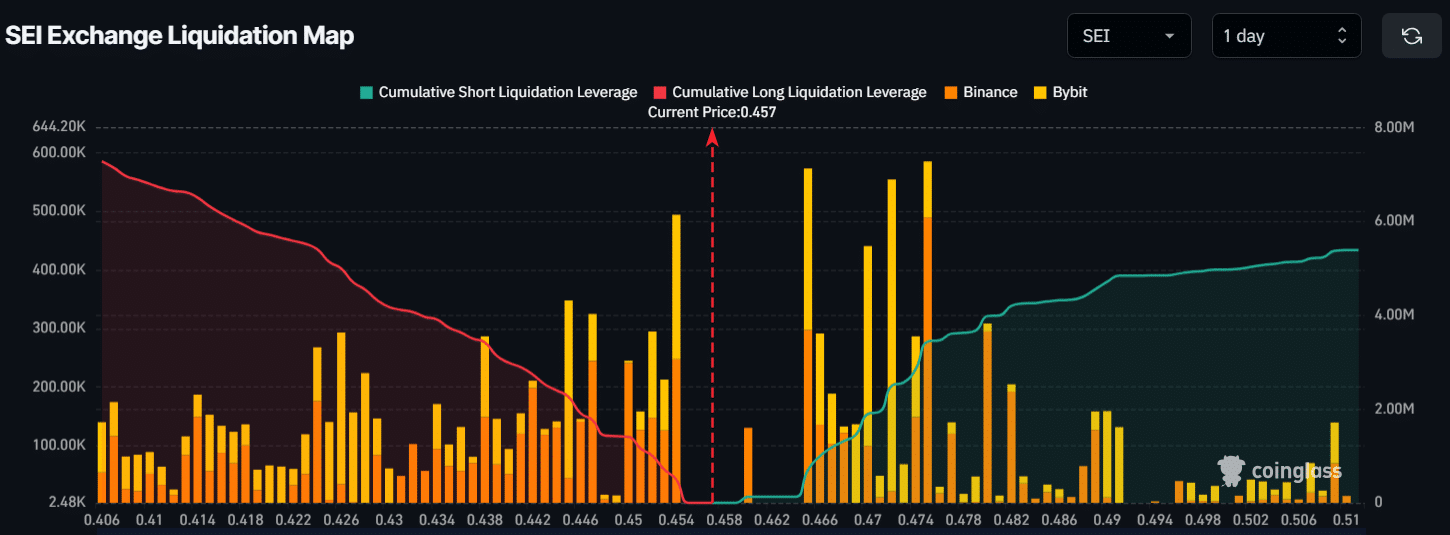

Basic levels of elimination

SEI’s key liquidation thresholds are currently around $0.454 on the downside and $0.475 on the upside, with significant leverage among day traders at these levels, according to Coinglass.

If the SEI falls to $0.454, nearly $494.47K worth of long positions could be liquidated. Conversely, a rise to $0.475 could result in approximately $3.44 million worth of short positions being liquidated.

At the time of publication, it appeared that the bulls were in control and could trigger liquidation of short positions at higher levels.