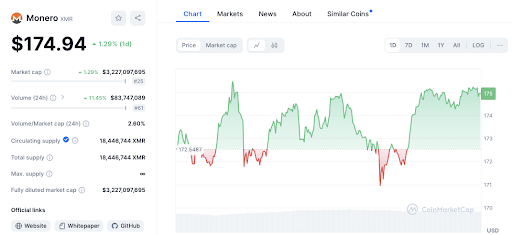

Monero (XMR) has recently seen a significant uptrend, trading at $175.01, up 1.47% in the last 24 hours. This positive move in Monero’s price can be attributed to a series of bullish moves that have unfolded over the past few days.

The cryptocurrency has been steadily rising from a low of around $172.55 to its current level, showing a consistent pattern of higher highs and higher lows. This price action suggests strong bullish momentum in the short term.

When looking at key support and resistance levels for Monero, a few ideas emerge. The immediate support level is around $172.50. This area previously served as a base for the price before its recent rally.

Additionally, there is a deeper support level at $171, which has also shown its ability to trigger a price bounce.

On the resistance front, Monero is currently testing the $175 mark. This resistance level is crucial as it represents the upper limit of the recent price action. If Monero manages to break this resistance level convincingly, the next potential resistance could be seen in the $176-$177 range. This forecast is based on the continuation of the current uptrend.

Volume data supports the ongoing bullish sentiment. Trading volume has increased by 12.53% in the last 24 hours, highlighting the growing market interest. This increase in volume is a positive indicator that supports the current price action.

Additionally, derivatives market data shows a significant increase in activity. According to Coinglass, Monero derivatives volume rose 35.21% to $33.77 million, while open interest increased 6.26% to $14.02 million. The 24-hour long/short ratio is 1.1137, reflecting slightly bullish sentiment among traders.

On Binance, the XMR/USDT long/short ratio is 0.6581, indicating more short positions. The top trader has a long/short ratio of 0.6838, with positions at 0.6861, indicating cautious optimism.

Liquidation data also shows interesting trends. Short positions are losing more than long positions. In the last hour, liquidations were $1.96K, up from $71.12K in 24 hours. This suggests that short positions are losing more across different time frames.

Technical indicators are also painting a mixed picture. The 1-week Relative Strength Index (RSI) for Monero is 60.21, suggesting that the cryptocurrency may be approaching overbought conditions, but is not yet in critical territory. Additionally, the 1-week Moving Average Convergence Divergence (MACD) is trading above its signal line, confirming the positive momentum.

Disclaimer: The information provided in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of using the content, products or services mentioned. Readers are advised to exercise caution before taking any action related to the company.