Enjoy the Empire newsletter on Blockworks.co today. Get news delivered straight to your inbox tomorrow. Subscribe to the Empire newsletter.

The value of the dollar is amazing

Central banks may be buying gold at record rates, but El Salvador is still busy hoarding savings.

And while gold is at new all-time highs, Nayib Bukele’s government has secured all the advantages thanks to its strategy of dollar-cost averaging of Bitcoin.

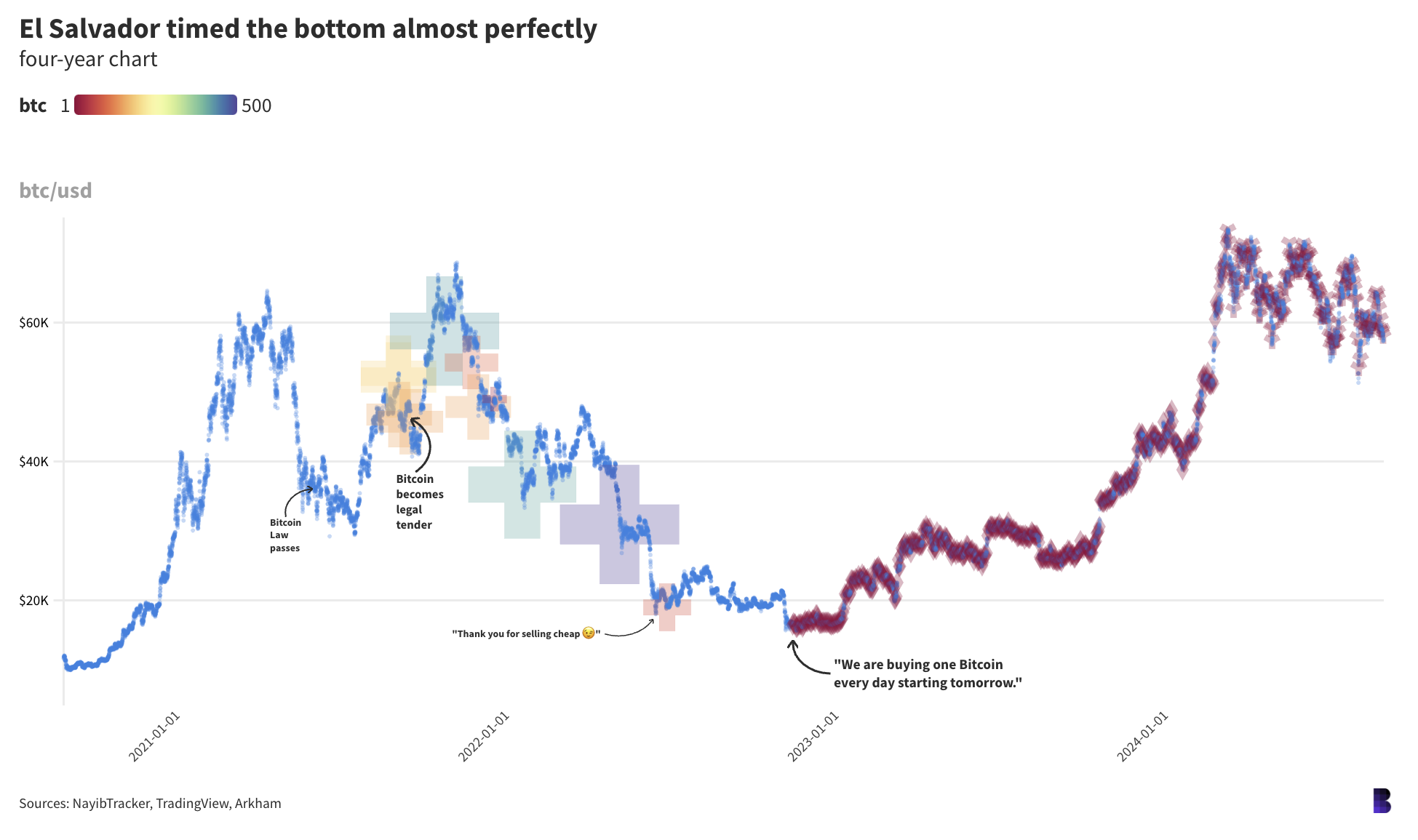

Bukele couldn’t have picked a better time to start regular buying: less than a week after FTX filed for bankruptcy.

Bitcoin had just fallen by a fifth due to the Sam Bankman-Fried crash, from over $21,000 to under $17,000, leaving it with a year-over-year loss of over 65%. That’s when Bukele decided to start buying bitcoin every day.

El Salvador had already purchased thousands of bitcoins in the 14 months leading up to the FTX collapse. The first purchases were made in September 2021, days before bitcoin officially became legal tender thanks to a law passed in June.

At least that’s what’s evident from the posts in Bukele’s news feed (shown as large colored plus signs in the chart below).

Bukele never showed on-chain receipts for his initial purchases, so we don’t know what price Salvador was buying at, except for one post where he noted buying 85 BTC at $19,000 each.

But if we take the price of Bitcoin at the time of Bukele’s tweets, El Salvador potentially spent $105.11 million on his initial 2,381 BTC, giving an average price of $44,145.

Bitcoin is currently trading at $58,460, meaning that the same amount would be worth $139.33 million, which would represent a paper gain of over 32%.

From there, things get even murkier before they become much clearer (and on-chain). Bukele only revealed the official Bitcoin wallet in March of this year, when El Salvador consolidated its Bitcoin treasury into a single address.

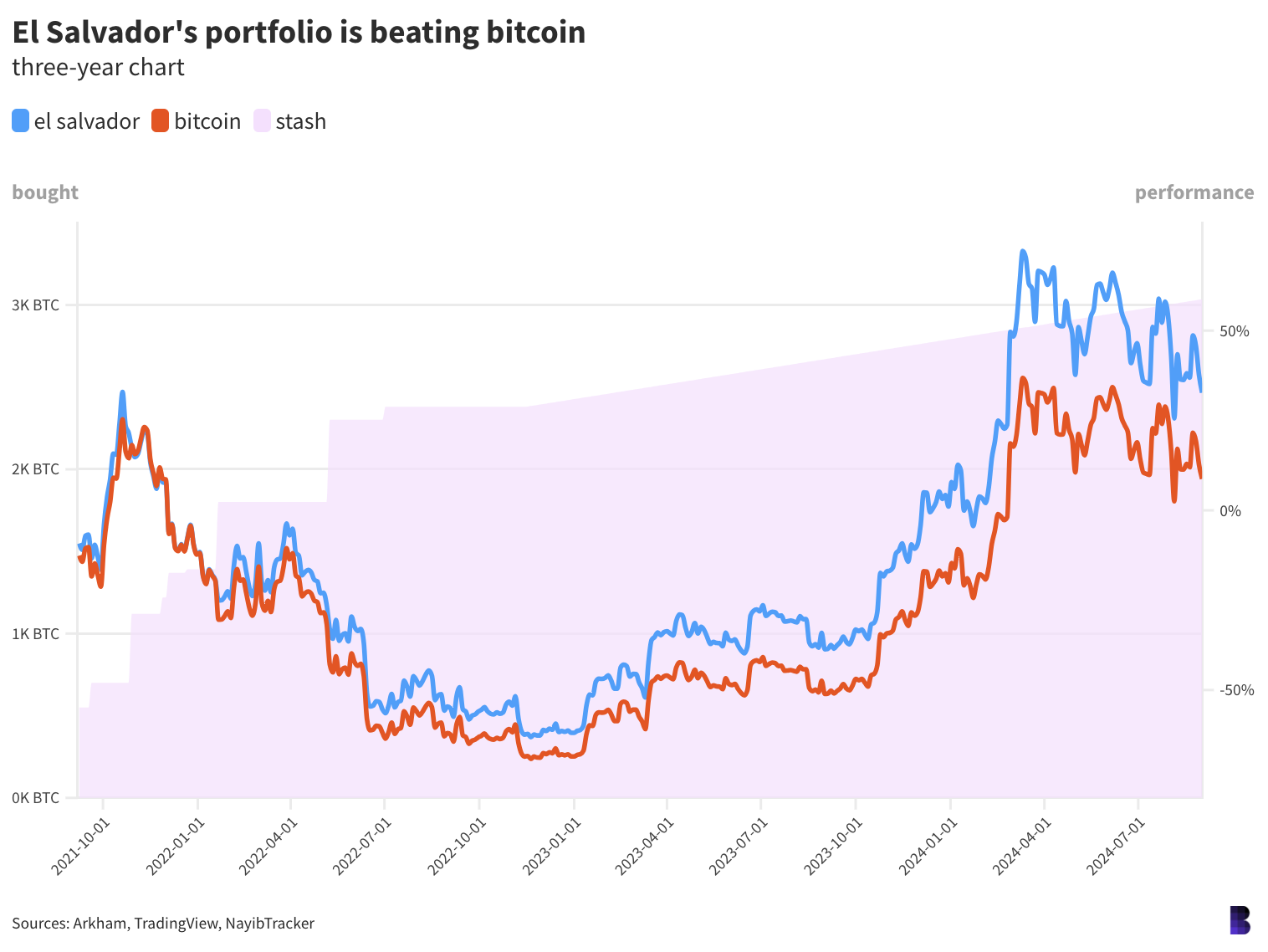

There were 482 days between Bukele’s announcement of his DCA plan at the bottom of the cycle and the March consolidation. So El Salvador would have bought 482 BTC for $14.84 million at an average price of $30,800.

The same production would have brought in about $28.2 million, giving the government a 90% advantage on these particular purchases.

However, the surprise was that El Salvador’s Bitcoin wallet contained almost twice as much Bitcoin as expected. The government should have held 2,863 BTC based solely on the purchasing patterns broadcast by Bukele’s Twitter posts.

After moving the bitcoins to a “cold wallet in physical storage on our national territory,” the El Salvador bitcoin address contained 5,689.7 BTC.

The distinction never seemed to be addressed. Bukele, around the same time, published a post saying that the government had earned revenue from bitcoin through its mining and passport programs, currency conversion, and public services.

In any case, Salvador does indeed continue to buy Bitcoin. His online history shows that new Bitcoin is being deposited into cold storage almost every day (there are occasional gaps where deposits don’t arrive, but they always arrive eventually).

We still can’t know exactly at what price El Salvador buys its daily bitcoin, we can only track how the purchased bitcoin is sent to a cold storage wallet. In the 173 days since we learned about the government bitcoin address, 172 BTC have been sent to cold storage.

Overall (and ignoring the extra bitcoins that came from Bukele’s wallet reorganization), my calculations show that El Salvador has bought 3,035 BTC worth $131.02 million since September 2021, at an average price of $43,169.

This would allow El Salvador to increase its Bitcoin purchases to date by more than 35%, or $46.38 million.

If you focus only on the bitcoins bought using dollar-cost averaging, the return is 47.5% ($38.23 million out of $25.9 million) – largely due to how well Bukele timed the market.

Keep cooking, I say.

Data center

- BTC And Ethereum rose 1% and 2.5% on the day, respectively. (BTC: $58,635; ETH: $2,530.)

- Both are still decreased by approximately 8% over the past week, according to CoinGecko.

- HNT – Best Performer first page over the period, up 14%. XMR is the only other token in the top 100 to rise more than 1%.

- Weekly TON DEX Volume Drops 55% Telegram CEO Pavel Durov posts $5.5 million bail.

- Pump.fun competitor Sun Pump has made its mark 10% of all smart contract calls on Tron over the past week. 76% is still tied to USDT.