Network Value to Transaction (NVT) is a powerful fundamental cryptocurrency analysis indicator often used to identify overvalued and undervalued cryptocurrencies. In this regard, Finbold has found two networks with a better NVT ratio than Bitcoin (BTC) that are likely undervalued compared to the leader.

Leading cryptocurrency NVT has been showing a noticeable upward trend since November 2022, as demand for BTC has begun to focus on off-chain transactions and derivatives trading – through futures contracts or spot Bitcoin ETFs.

We received data from Sentiment On July 21, posting a record seven-day network value to transactions ratio of 205.63. In fact, Sentiment It is calculated by dividing Bitcoin’s market capitalization by the volume of transactions on the network over the past seven days.

Thus, a higher NVT means that the market valuation is proportionally higher than how much value the network moves. According to this metric, BTC may be overvalued because its transaction volume on the blockchain is stagnating while the price continues to rise.

Lower NVT: Undervalued Cryptocurrencies Vs. Bitcoin

Interestingly, other cryptocurrencies with lower capitalizations have moved proportionally higher value across their networks, indicating asymmetry. These coins may be undervalued compared to the market leader, offering an interesting opportunity for less conservative investors.

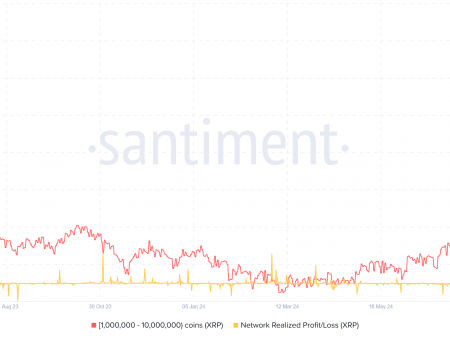

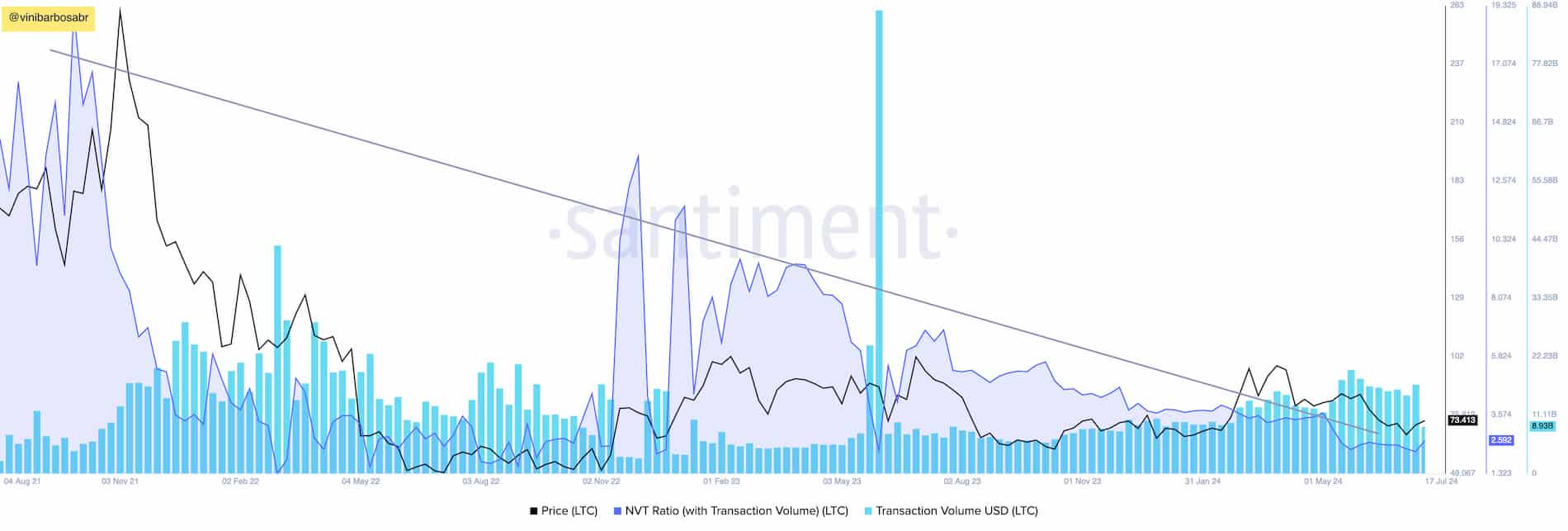

Litecoin (LTC): 2.59 NVT

Firstly, Litecoin (LTC) is showing the exact opposite scenario to Bitcoin, with a downward NVT trend as the network processes a stable transaction volume despite the price drop.

At the time of writing, LTC is trading at $73.41, confirming $8.93 billion for the week. This results in a highly undervalued network value to transaction ratio of 2.59.

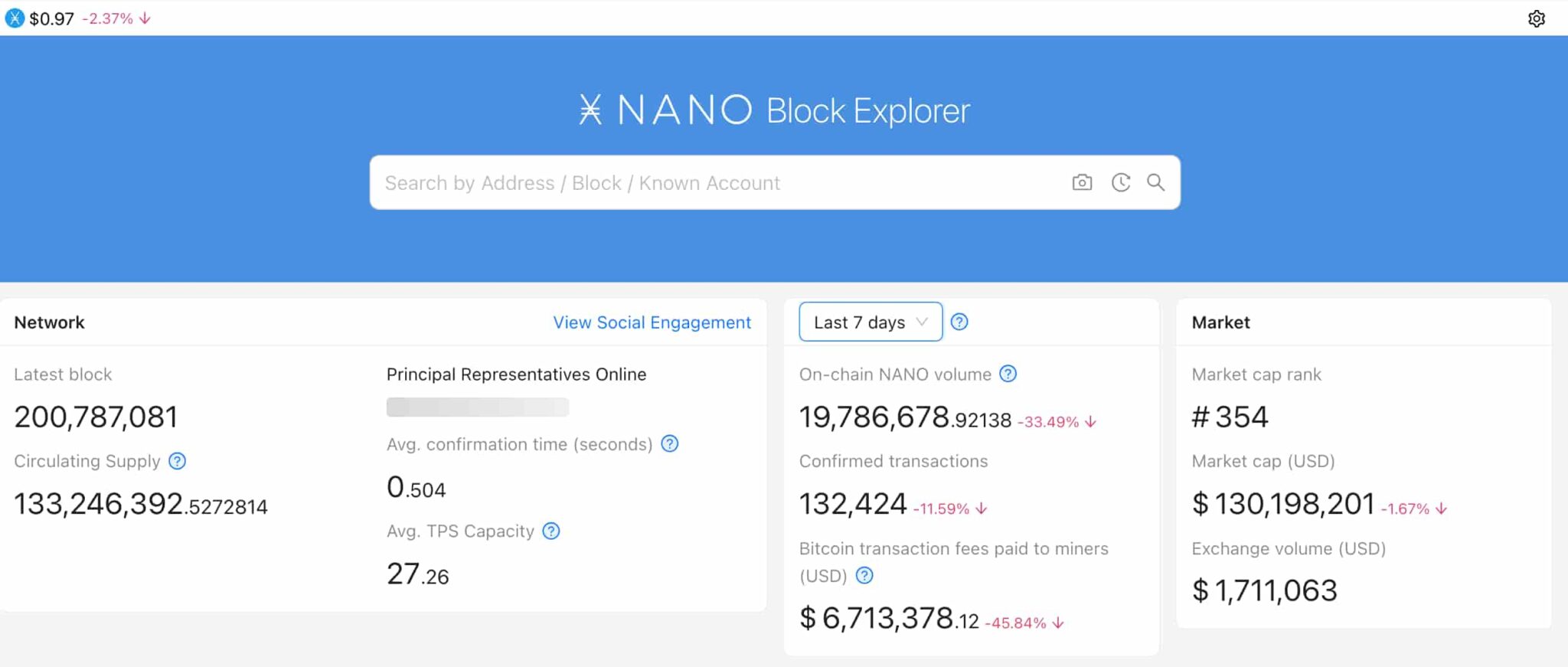

Nano (XNO): 6.78 transaction network value

Notably, the Nano (XNO) network has confirmed 132,424 transactions worth 19.78 million XNO in the last seven days. Given the price of $0.97 per coin, this gives a seven-day transaction volume of $19.18 million. Data taken from BlockLattice.io.

The project currently has a market cap of $130.2 million, based on a fully circulating supply of 133.24 million XNO. Thus, Nano’s network value to transaction ratio of 6.78 suggests an undervalued cryptocurrency weighted by its use and market cap.

However, a low NVT does not guarantee that these cryptocurrencies will outperform Bitcoin. It is the only fundamental analytical indicator that investors can use in addition to further analysis and research.

Denial of responsibility: The content of this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk