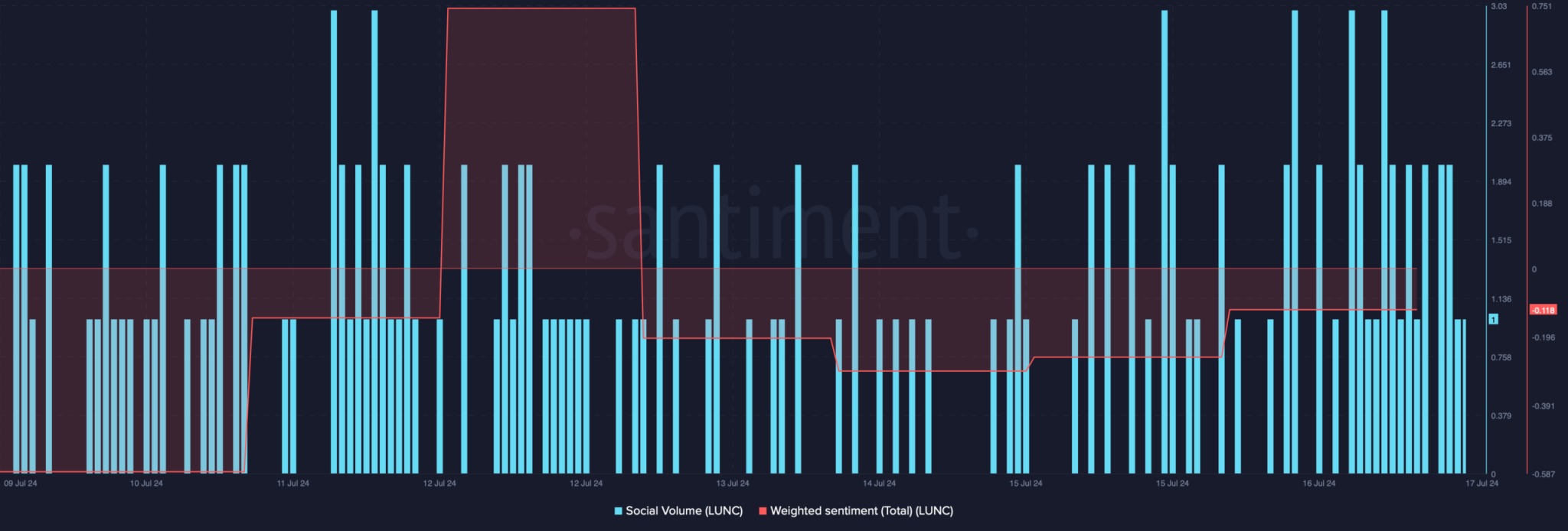

- Despite the increased social media volume indicating the growing popularity of Terra classic LUNC, social media data showed that the measured sentiment remains negative, reflecting the bearish market sentiment.

- Technical indicators such as MACD showed bullish advantage, while a slight decline in RSI and significant liquidations at $0.000086 level pointed to a possible price correction.

LUNC, the native cryptocurrency of the Terra Classic ecosystem, has been in the spotlight with a 30% gain over the past week. However, after facing rejection at $0.000095 earlier on Wednesday, LUNC price has been moving sideways. At press time, LUNC is trading down 3.7% at $0.00008713 with a market cap of $474 million.

The derivatives market looked optimistic. According to Coinglass, the Long/Short Ratio LUNC has improved, indicating more long positions than short positions at press time. This suggests that investors expect the token price to rise in the coming days.

How long will the Terra Classic (LUNC) rally last?

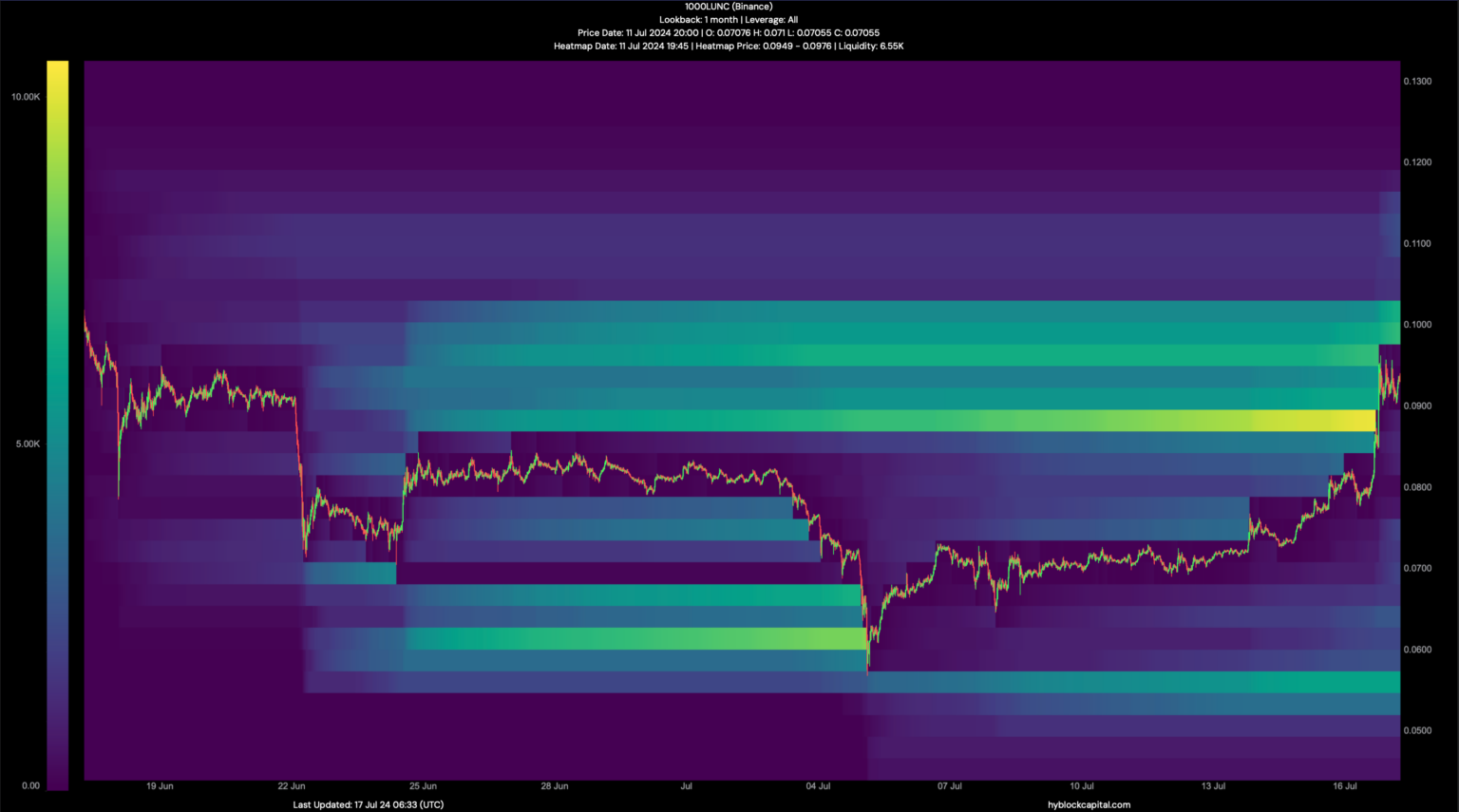

The daily chart of Terra Classic shows that LUNC was testing a critical resistance level at the time of publication. For Terra Classic to maintain its bullish run, it needs to break this mark. The MACD technical indicator has shown a clear bullish advantage in the market. However, the Relative Strength Index (RSI) has registered a slight decline, which could create potential problems.

Moreover, the liquidation heat map also shows that a large amount of LUNC was liquidated when its price touched $0.000086. This suggests a potential price correction in the coming days. If this happens, LUNC may enter a consolidation phase.

Last week, CNF reported that Terra Classic was preparing to upgrade its split entry, which could give hope to investors moving forward.

Terra Luna shows optimistic trends

LUNC’s sister token Terra LUNA has also seen a bullish move in the last week, gaining over 18%. At press time, Terra LUNA is trading at $0.4389 with a market cap of $350 million, and daily trading volumes have skyrocketed by 100%.

In a major development for Terra Luna, the bankruptcy court has issued a new order authorizing several key actions for Terraform Lab (TFL). These include reopening the Shuttle Bridge to redeem wrapped assets and implementing a plan to transfer and burn a significant number of LUNA tokens.

1/ Dear Terra Community,

We would like to inform you of the recent TFL Chapter 11 bankruptcy court ruling authorizing TFL to do the following: 1) reopen the Shuttle Bridge to redeem wrapped assets on Terra Classic; 2) un-delegate and burn 150 million LUNA…

— Terra 🌍 Powered by LUNA 🌕 (@terra_money) July 19, 2024

The court ruling allows TFL to reopen the Shuttle Bridge, the platform used to buy back wrapped assets on Terra Classic. This will allow users to access their assets through a new, more secure interface. However, in the latest development, Terral Classic has denied any plans to merge with LUNA, according to a CNF update.

The Shuttle Bridge will remain open until 30 days after TFL’s Chapter 11 plan is effective. After that time, the bridge will be permanently closed and all remaining assets will be incinerated. The Chapter 11 plan has not yet been approved and is not expected to take effect until late September 2024.