Welcome to On the Margin, a newsletter presented by Casey Wagner and Felix Jovin. Here’s what you’ll find in today’s edition:

- Why Digital Asset Compliance Is a Low Priority for Crypto Companies? Unpacking the Survey Results

- VCs are making fewer but bigger crypto deals in Q2. Let’s look at the numbers.

- It’s Friday! Read our roundup of this week’s news that you might have missed.

Trouble in Rules Paradise?

Compliance with SEC compliance rules is probably one of the biggest concerns keeping crypto executives up at night. However, a recent survey shows that in the world of TradFi, digital assets are the least of their worries.

A survey of compliance professionals at 595 investment advisory firms shows that digital asset compliance is among the lowest priorities at these firms today.

Investment advisers are most concerned about electronic and so-called “off-channel” communications controls, according to a survey by the Investment Advisers Association, ACA Group and Yuter Compliance Consulting. Concerns about communications compliance now outweigh those related to advertising and marketing, which ranked second, according to the survey.

About 93% of respondents indicated that their digital asset compliance testing programs have “not changed.” 4.3% of respondents said they have increased cryptocurrency-related compliance testing over the past year.

Only 1.49% of respondents said digital assets were the focus of their most recent SEC inspection, which the securities regulator conducts at its discretion.

Surprisingly, it appears that SEC exams may be gaining popularity. 85% of survey respondents reported that they are currently taking or have taken the SEC exam within the last five years.

The relative lack of interest in digital asset compliance is unsurprising. Registered investment advisers (RIAs) in the U.S. are limited in their ability to offer crypto products to their clients. This structure partly explains why the recently approved spot Bitcoin ETFs were so innovative; they are one of the few products that RIAs can purchase on behalf of their clients.

According to Bitwise, as of May 2024, RIAs have purchased $3.5 billion worth of spot BTC ETFs. And it’s not just the largest funds that have shown interest.

Legacy Wealth Asset Management, a Minnesota-based RIA with 398 clients and $394 million in AUM, bought 352,594 shares of the Fidelity Wise Origin Bitcoin ETF (FBTC) for $21.9 million, the firm disclosed in April. Another fund, Kansas-based United Capital Management, with $304 million in AUM, bought 349,999 shares for $21.6 million, according to disclosures.

As opportunities for investment advisors to engage with the crypto industry grow (we’re looking at you, Ethereum ETFs), we’ll be curious to see if compliance concerns also increase. Of course, clients will have to show demand for these types of investments for their advisors to get involved, so TradFi’s sentiment around crypto is another area to keep an eye on.

— Casey Wagner

0.15%

That’s the new planned fee for Grayscale’s Ethereum Mini Trust, according to a disclosure filed late Thursday.

The amount represents a reduction from the 0.25% fee Grayscale disclosed in a filing a day earlier.

If issuers maintain planned fees until the expected launches next week, Grayscale’s offering will become the cheapest spot ETH ETF in the US market.

Grayscale’s fees are lower than the prices offered on Ethereum funds by competitors Franklin Templeton (0.19%), VanEck (0.20%), Bitwise (0.20%) and 21Shares (0.21%).

Slightly higher fees will be charged by BlackRock (0.25%), Fidelity (0.25%), and Invesco/Galaxy (0.25%). Grayscale Ethereum Trust (ETHE) plans to charge 2.5%.

Grayscale’s Ethereum Mini Trust is designed to hold 10% of its ether holdings in ETHE, which also provides it with liquidity in the early stages.

Give more for less

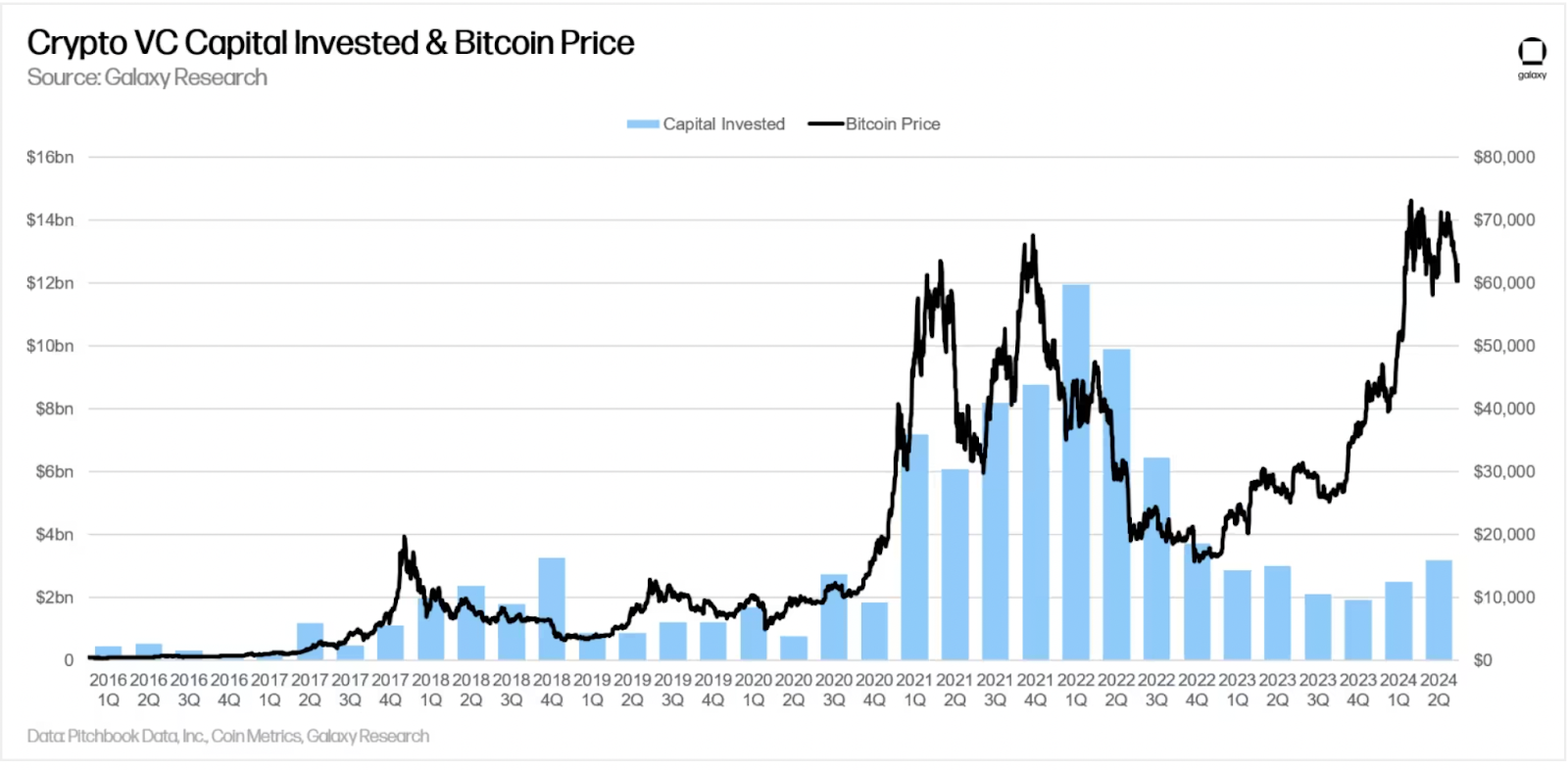

Venture capitalists made fewer crypto deals in the second quarter than in the first three months of 2024, but the size of the deals increased significantly.

Venture capital firms poured $3.19 billion into cryptocurrency and blockchain-focused companies in the second quarter, up nearly 30% from the first quarter. However, the number of deals fell 4% from the first to the second quarter, to 577 by the end of June, according to research from Galaxy Digital.

The numbers may seem staggering, but they are far below the golden era of crypto venture investing in 2021 and 2022.

In the first quarter of 2022, venture capitalists poured $12 billion into digital asset companies. In the following quarter, the total deal size fell to $10 billion, which is still more than three times the numbers we see today.

As Galaxy analysts point out, the trades don’t seem to correlate much with the price of Bitcoin. But while BTC was setting all-time highs in 2024, the industry was breaking another record: the number of crypto-related enforcement actions by the SEC has nearly doubled since 2021.

In 2023, the SEC filed 46 lawsuits related to cryptocurrencies, most of which were settled out of court. This has saved firms, and especially smaller startups, the money and time that litigation would take. But settlements do not set precedents, so we find ourselves in a kind of endless loop, at least for now.

We can’t imagine crypto VCs are looking forward to backing companies that may soon be forced to terminate offerings or pay outrageous legal fees. But if Q2 numbers are any indication, that could change. Plus, the SEC closed two major investigations into Hiro Systems and Paxos just this month, so perhaps Q3 will bring additional VC interest.

– Casey Wagner

You noticed

- The Democratic Party appears to be in disarray amid a steady stream of conflicting news stories. This morning, for example, NBC reported that Biden’s family had begun discussing his withdrawal from the race. Moments later, a White House spokesman said the report was false. This pattern of conflicting news about the status of Biden’s candidacy leaves people confused about which way is up.

- After a series of weak economic data, the Atlanta Fed’s Nowcast GDP model has started to rise, indicating that the economic slowdown we’ve been seeing is starting to reverse.

- The German government has run out of coins to sell, and the cryptocurrency is recovering and catching up with stocks that have been there for the past month, setting new all-time highs in a day. BTC is up 3.8% today.

– Felix Joven