Former US President Donald Trump has hinted at possibly appointing JPMorgan Chase (NYSE: JPM) CEO Jamie Dimon to his cabinet as Treasury Secretary if he is re-elected.

It’s worth noting that Dimon has become a vocal critic of Bitcoin (BTC), at one point calling it a “fraud.” He has argued that Bitcoin lacks the basic qualities needed for a currency.

On the other hand, Trump has shown increasing inclination towards the cryptocurrency space in recent months, stating that he intends to make Bitcoin one of his priorities if he is re-elected in November.

If Trump wins re-election and appoints Dimon to his cabinet, Finbold will turn to OpenAI’s ChatGPT-4o artificial intelligence (AI) tool to gather information on how Bitcoin is likely to trade in 2025.

AI Bitcoin Prediction 2025

An artificial intelligence tool has suggested that if President Trump, known for his growing support for the cryptocurrency space, continues to push for favorable regulation, it could lead to wider adoption and a significant increase in the value of Bitcoin.

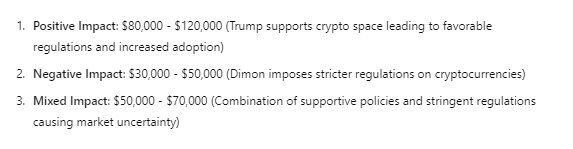

Despite Jamie Dimon’s critical stance, Trump’s overarching pro-crypto policies could prevail, potentially sending Bitcoin’s price to $80,000-$120,000. This would mark a new all-time high for Bitcoin compared to its current valuation.

On the other hand, if Dimon, known for his critical views on Bitcoin, gains significant influence over Treasury policy, the regulatory environment could become much stricter. This could stifle the growth and adoption of cryptocurrencies, leading to a potential decline in the price of Bitcoin, possibly pushing it into the $30,000 to $50,000 range.

At the same time, the AI tool provided a more detailed scenario considering the combination of Trump’s supportive policies and Dimon’s strict rules. This could lead to market uncertainty and volatility, with the price of Bitcoin experiencing significant fluctuations, reaching the $50,000 mark to $70,000.

Other Factors Affecting Bitcoin in 2025

AI speculative analysis highlighted that these price predictions are dependent on the political landscape and regulatory environment. Other critical factors such as technological advancements, broader market adoption, macroeconomic trends, and global events will also play a decisive role in shaping the future price of Bitcoin.

It is worth noting that Bitcoin has shown significant bullishness after breaking through the $60,000 resistance level. This new trajectory emerged after the failed assassination attempt on Trump, which increased the chances of his re-election.

At the time of publication, Bitcoin was trading at $65,080, with a daily gain of more than 2%. On a weekly timeframe, BTC has grown by almost 11%.

Denial of responsibility: The content of this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.