Enjoy the Empire newsletter on Blockworks.co today. Get news delivered straight to your inbox tomorrow. Subscribe to the Empire newsletter.

Only Sunday scary stories?

Unlike most Americans, Bitcoin’s volatility didn’t take a breather to celebrate the holiday weekend. Bitcoin hit $54,000 on Sunday before bouncing back overnight. It’s currently trading around $57,000.

Memecoin has not been spared the sell-off, with some tokens like dogwifhat still topping the top 100 biggest losers, according to CoinGecko.

Is this all super surprising? Not really. Traders are taking stock of Mt. Gox’s payout action, coupled with selling pressure from the German government, which continues to dump chunks of its $2 billion worth of Bitcoin holdings. And then we have to note that we’re still in the throes of summer…

“The high selling pressure on the network may be related to the start of Mt. Gox’s payouts, which investors have been waiting for years. While investors may wait up to 90 days to access funds, the official news of the payouts, confirmed by the verified movement of 47,228 BTC from a cold wallet associated with Mt. Gox to a new address likely intended for payouts, triggered a market reaction,” wrote Matteo Greco, an analyst at Fineqia, in a note this morning.

If you’re feeling a little optimistic on this fine Monday morning, I’ll show you a yearly chart of Bitcoin, which also shows the buying we saw after its plunge on Sunday evening.

A few weeks ago, I spoke with John Glover of Ledn about his technical forecast for Bitcoin. He gave two levels to watch: between $55,000 and $56,000, and $49,000. Keep those numbers in mind as the summer continues.

“I think it’s hard to time the crypto markets in the near term, but this is probably the most challenging situation I’ve seen, especially with stocks rising, rates high, and cryptocurrencies trending strongly. [volume]”,” Empire podcast host Santiago Santos wrote on X.

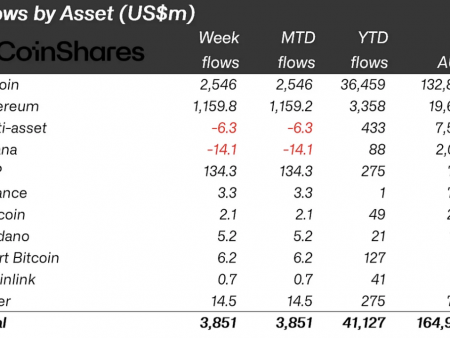

CoinShares believes the weakness has provided some investors with a buying opportunity — in ETFs, that is. Analyst James Butterfill noted that crypto investment products saw $441 million in inflows last week.

“At the regional level, the inflow of investments came mainly from the United States, which received $384 million. [million]”While opportunistic buying was seen in many countries, the most notable were Hong Kong, Switzerland and Canada, which saw outflows of $32 million, $24 million and $12 million, respectively. Germany was the exception, with outflows of $23 million,” Butterfill wrote.

Greco noted that this is the first time that a market decline does not correlate with ETF flows.

“Historically, Bitcoin spot ETFs have had a significant impact on market activity and price action, with strong correlations between ETF flows and price action. However, for the first time since their inception, there has been a noticeable divergence between price action and capital flows, indicating that recent price action has been driven largely by trading activity in the crypto-native space,” he wrote.

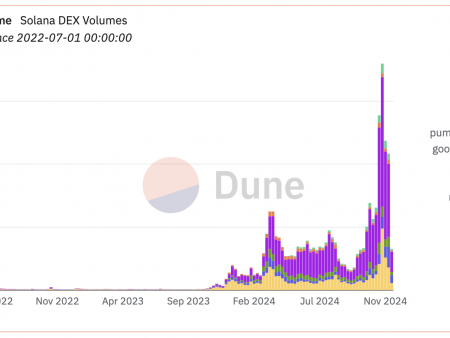

But volumes for food products were down, which again is not surprising given the seasonal trends. The third quarter typically has the “lowest trading activity.”

“This data should not be taken negatively, but rather as a seasonal trend, especially among traditional financial investors,” Greco said. The total volume of ETPs, according to CoinShares, was $7.9 billion.

Friends, fasten your seat belts and prepare for continued instability as we experience the hottest days of summer.

– Katherine Ross

Data center

- USDT Supply It has fallen by $700 million in the last week, the biggest decline since August 2023, according to The Tie.

- TIA And STRK are recovering the fastest, by 14% and 9% respectively, although both figures were significantly lower than expected this year.

- TVL in DeFi fell nearly 10% in July, to $86.77 billionwhich is the lowest level since mid-April, according to DeFiLlama.

- Daily Bitcoin fees were only $712,353 on Sunday — the smallest payout since Halloween, according to CoinMetrics.

- Weekly active addresses on Explosion has nearly halved since last month’s distribution, from 578,000 to 313,400.

Traumatic connection

Bitcoin has our attention riveted to the charts now.

Few are likely to do so as this year’s newcomers, the first-ever Bitcoin ETF shareholders, are doing.

BTC is now more than 20% below its record set in March, which means a bear market is now underway, according to TradFi.

These old rules don’t really apply to cryptocurrencies. Bitcoin, Ethereum, and virtually every other cryptocurrency regularly see swings of this magnitude, even during bull markets, even if they’re becoming less common.

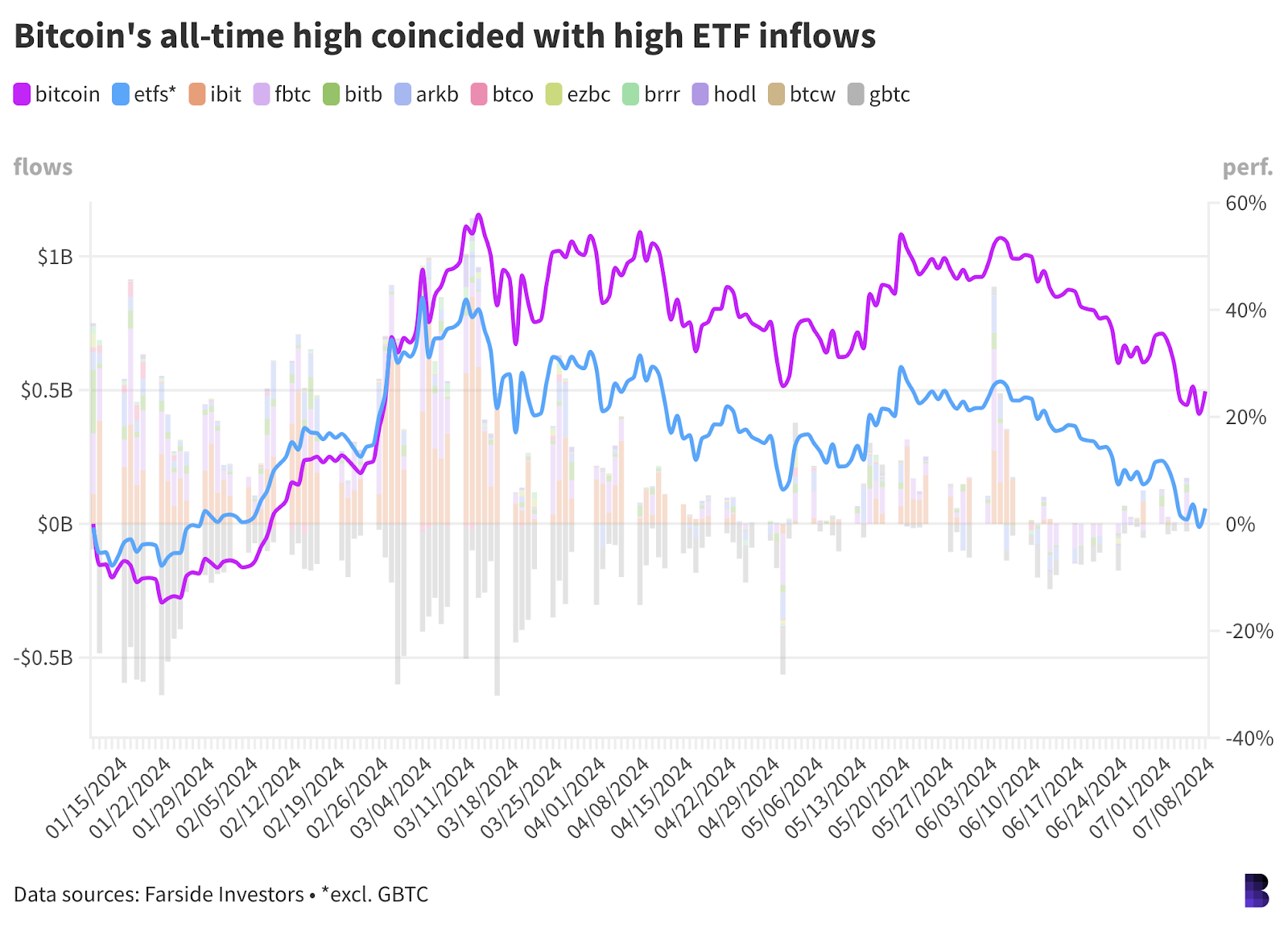

All of this puts buyers of the new spot Bitcoin ETFs in an awkward position. The funds debuted in early January — when Bitcoin was trading around $44,000 — three months before its current all-time high of nearly $73,400. Earlier this morning, Bitcoin changed hands for about $57,800.

Each ETF’s share price is closely tied to the price of Bitcoin. But are the funds themselves still worth the Bitcoin they’ve bought for their shareholders today?

Fortunately, comparing daily flow data with Bitcoin prices gives a decent estimate of how much Bitcoin each fund was buying per day.

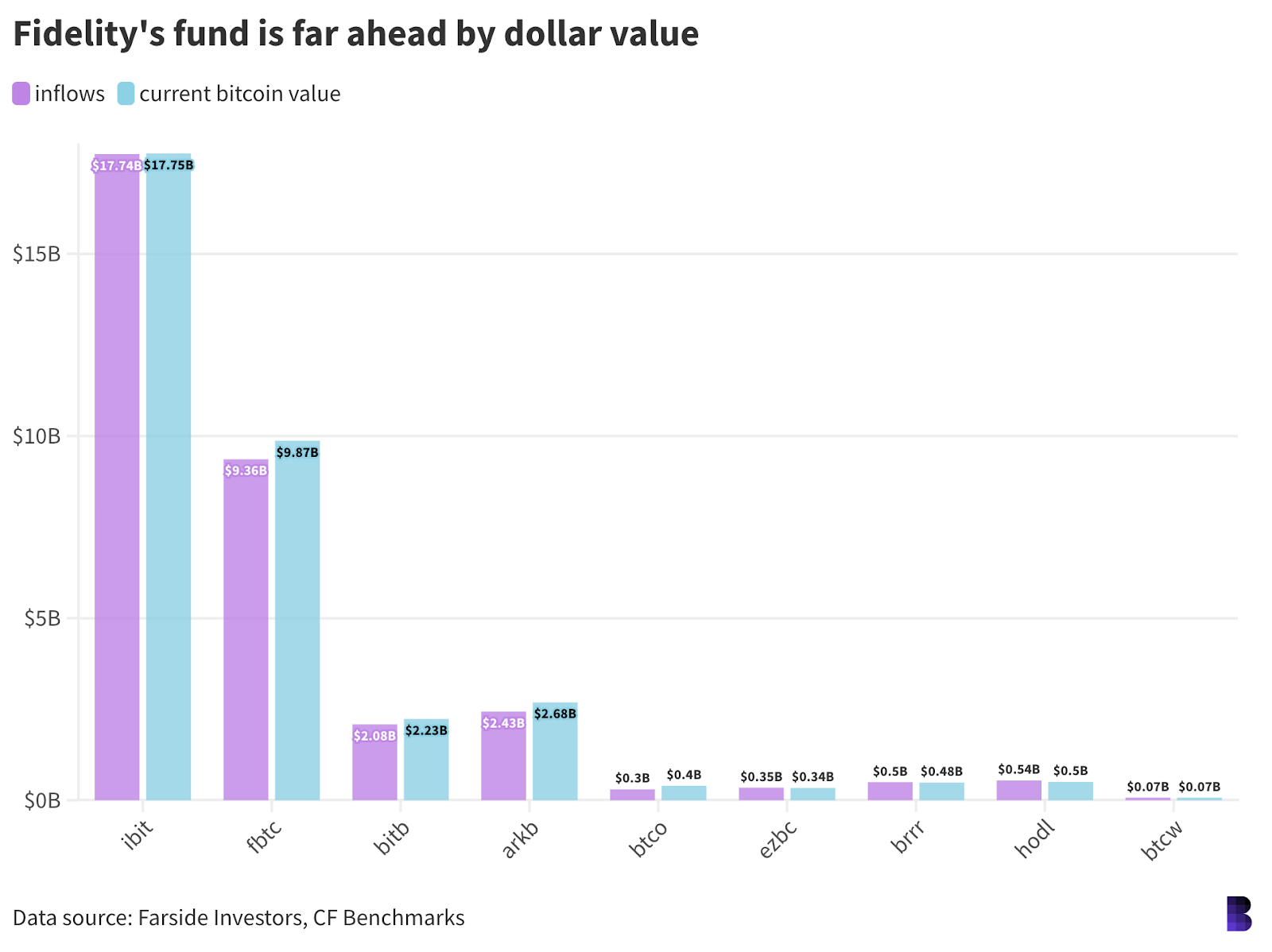

(As of Friday, U.S. Bitcoin ETFs had added a total of $14.76 billion to their Treasury holdings since their launch. But for the purposes of this analysis, we’ll remove GBTC from the calculations, leaving net flows to date across the nine new ETFs at $33.37 billion.)

The purple line in the chart above shows the price of Bitcoin, while the blue line represents the value of the Bitcoin Treasury bond spot ETFs based on their cumulative net flows. A value above zero means that the Bitcoin held by the ETFs is now worth more than they roughly paid for it.

The daily flows are the bars in the background. Note that they far exceeded GBTC outflows around Bitcoin’s all-time high, but fell significantly when Bitcoin’s price pulled back, meaning few people bought the dip to $58,200 in early May.

In terms of percentage growth in Bitcoin, Invesco-Galaxy’s BTCO still leads by a wide margin, up 33% in net flows to date. Bitcoin is up just 23% over the same period.

Much of the inflow into BTCO came during the low Bitcoin price period in January, while some shareholders pulled out funds en route to the all-time highs (buying low and selling high as a group).

BlackRock’s IBIT outperformed the market by only a small 0.09% based on a price of $57,822, equivalent to $15.5 million on net flows of $17.74 billion.

Fidelity’s FBTC is the best performer by dollar value, up nearly 5.5% to $9.36 billion. Paper gains are about $509 million.

For those who own Bitcoin, ETFs, or any other form of cryptocurrency investment, the big question now is whether Bitcoin has formed a “double top” — a bearish pattern involving two price peaks at roughly the same level.

Double tops occur when the market encounters significant selling resistance and buyers fail to break the wall in two largely separate attempts.

It looks like Bitcoin is forming two tops, however, there are some pretty strict rules about what constitutes a double top, especially regarding the size of the corrections.

Popular trader Peter Brandt seemed to suggest on X overnight that Bitcoin’s price hasn’t reached those levels yet. Which would be good news for ETF buyers — and everyone else.

— David Kanellis

Works

- Jeffries analysts noted that Bitcoin mining In June, profitability increased, while the network hashrate fell by 5%.

- North Carolina Governor Roy Cooper has vetoed an anti-CBDC bill that passed both houses.

- Co-founder of Samourai Wallet William Lonergan Hill was released on bail, The Block reports.

- Multicoin pledged $1 million to support pro-cryptocurrency Senate candidates.

- Japan Metaplanet The company announced that it had bought more bitcoins.

Reef

Q: Is cryptocurrency prepared for extreme volatility?

If you think Bitcoin rises or falls depending on good or bad news, you’re right. It always has.

There will always be companies, protocols, foundations, DAOs, and organizations that will carry the ball when prices go one way or the other. Others will benefit.

Rapid price declines in different corners of the DeFi market are leading to various tensions, like the one that hit Curve last month due to millions in bad debt.

Certain situations will undoubtedly require project founders, investors and other market participants to take crisis management measures.

But crypto myself — as in basic plumbing — will probably be fine, especially in the more decentralized parts of the market. It just might require some firefighting.

— David Kanellis

I hope so.

But seriously, I think it is. Volatility can make price action look scary, but if I’ve learned anything, it’s that technical analysis is your friend if you’re an anxious person (that’s me).

Cryptocurrency handles volatility quite well, although it obviously does harm when extreme situations occur. The key, especially for investors, is not to panic.

As David noted, some sectors of the market may be weaker than others, but overall, cryptocurrency is in a really good position right now.

We’ve lived through the TerraUSD crash and the post-FTX doldrums. The market is ready to batten down the hatches and wait out the so-called storm if need be, but we’re far from that now.

Keep calm and carry on, crypto can withstand some volatility.

– Katherine Ross