As the US presidential election approaches, Bitcoin and cryptocurrency have become key political talking points in a way that hasn’t been seen before. This can be partly attributed to the relative youth of the industry, as Bitcoin had been around for eleven years at the time of the 2020 election, Ethereum had only been active for five years, and many key DeFi protocols were only two or three years old (for example, Maker launched as a working product in 2017, Uniswap and Compound in 2018).

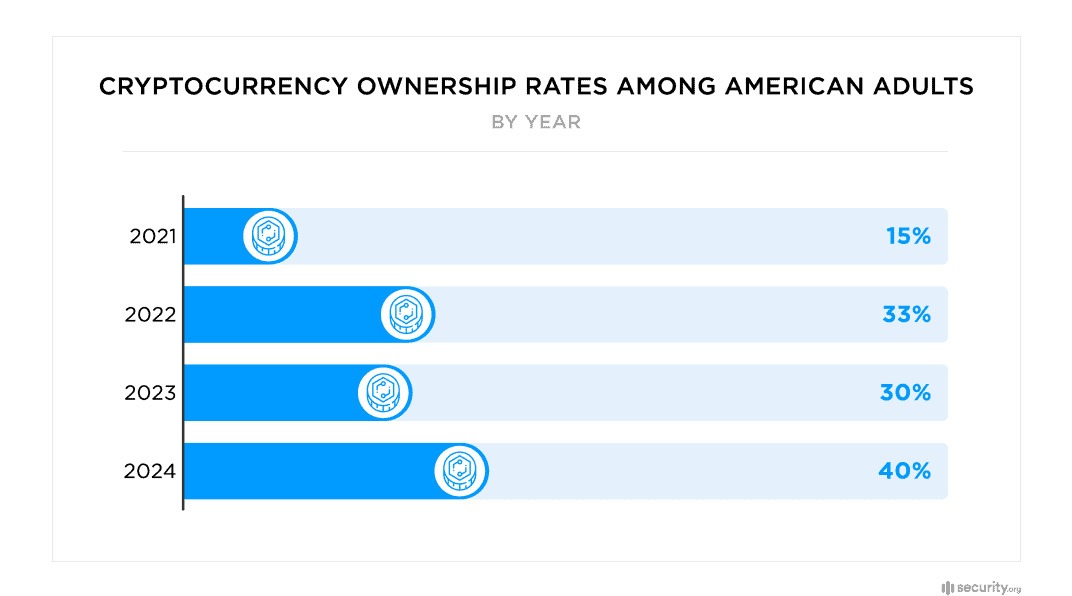

But fast forward to 2024, and the landscape is rapidly changing: BTC spot ETFs run by BlackRock and Vanguard (among others) are now part of the TradFi landscape, ETH spot ETFs are also set to launch this summer, and according to a recent report, 40% of Americans now own cryptocurrency.

Data from Security.org

This time, crypto has become too big to ignore, Wall Street has gone ahead and put Bitcoin on its menu regardless of politics, and, what’s more, the crypto-hostile Securities and Exchange Commission (SEC) has forced crypto industry leaders to take positions where resistance is a matter of survival, which increasingly means conformity, and influencingpolitical candidates who advocate for cryptocurrency.

After all, if SEC litigation becomes the norm for crypto companies, and the SEC is approved by the Biden administration, the crypto industry is unlikely to agree to a continuation of the previous events.

Of course, to join an alternative that supports cryptocurrency, it is necessary that there actually be be a candidate who supports cryptocurrency, which in turn could spur the creation of pro-crypto policies among candidates, and if we look at the Trump camp and the support that Trump is receiving from the crypto industry, we can see this dynamic unfolding.

Kraken Founder Donates to Trump

In late June, Jesse Powell, the founder of major cryptocurrency exchange Kraken, published a post on X announcing that he had personally donated $1 million, mostly in ETH, to Donald Trump. Powell describes Trump as “the only pro-crypto major party candidate in the 2024 presidential election” and explicitly states that “the crypto industry has been under attack by Elizabeth Warren, Gary Gensler, and others,” also claiming that “the Biden White House has stood by and allowed a campaign of unchecked regulation through coercion.”

I just personally donated $1M (mostly #ETH) to @realDonaldTrump.

For too long, the crypto industry has been under attack from Elizabeth Warren, Gary Gensler, and others. Despite overwhelming bipartisan efforts in Congress to set clear rules, the Biden White House… pic.twitter.com/Ksxf3P2oCb

— Jesse Powell (@jespow) June 28, 2024

Powell’s post places blame squarely on the Democratic administration and the SEC, and, notably, it ends with the hashtag “#freeross.” This is a reference to Ross Ulbricht, who was sentenced in 2015 to double life in prison plus 40 years without parole for creating and operating the online black market Silk Road, which largely facilitated drug trafficking paid for in BTC. It’s relevant to Powell’s post because last month Trump promised, if elected, to commute Ulbricht’s sentence to time served, demonstrating an awareness that the Silk Road operator’s imprisonment is a major issue among Bitcoin veterans who view Ulbricht’s sentence as disproportionately harsh.

Other Cryptocurrency and Business Leaders Back Trump

Jesse Powell isn’t the only cryptocurrency celebrity to publicly endorse Trump. Support has also come from Gemini founders Tyler and Cameron Winklevoss, as well as ARK Invest founder and CEO Cathie Wood, who has stated her voting intentions: “I’m a voter when it comes to the economy, and therefore Trump.”

In June, tech entrepreneur David Sachs’s San Francisco home also hosted a pro-Trump fundraiser, and late last month, hedge fund manager Bill Ackman posted what seemed like an indirect endorsement, or at least a call for productive work if Trump wins. He said “the country needs to rally around Trump and help him succeed” because Trump “will win in a landslide.”

.@realDonaldTrump will win in a landslide. The country must rally behind Trump and help him succeed.

Trump did not expect to win the first time he was elected. As a result, he was completely unprepared. The lack of preparation, the Russia investigation, and the ensuing…

— Bill Ackman (@BillAckman) June 28, 2024

Additionally, Bitcoin Magazine CEO David Bailey publicly announced in May that his organization was “collaborating with the Trump campaign to develop a policy agenda around bitcoin and cryptocurrency.” This announcement came shortly before the Trump campaign began accepting cryptocurrency donations, and before Trump spoke out against Ross Ulbricht and received praise for his commitment to supporting bitcoin mining in the U.S.

Are SOL ETF Orders a Trump Bet?

Last month, both VanEck and 21Shares filed for SOL spot ETFs. While similar products for BTC and ETH were approved, a Solana fund seemed unlikely because it moves further down the altcoin risk curve and there is no existing Solana futures market.

Some observers thus interpreted the filings as a bet on the upcoming Trump presidency bringing crypto-friendly changes to the SEC. Accordingly, speculation began about who might take over the SEC chairmanship under these circumstances, and Dan Gallagher was one name that was circulated in the media and was met with enthusiasm. Gallagher is a current CLO at the Robinhood trading and investment platform and a former SEC commissioner, and one might expect him to have an open mind when it comes to cryptocurrencies.

Speculation about appointments is just that, speculation for now, but expectations are real that the SEC’s character will change under a new chairman. Moreover, last month the Supreme Court struck down the Chevron Doctrine, which is expected to shift authority (over interpreting acts of Congress) from regulators back to the courts, perhaps limiting the extent to which the SEC can—as its critics argue—rule through coercion.

However, at this point it is safe to say that the crypto industry, which has repeatedly expressed its dissatisfaction with American regulators, now sees opportunities in the next elections.